By Anthony DiPaola and Javier Blas

Aramco’s pricing announcement is the first major marketing decision since producer talks in Vienna ended in dramatic failure on Friday, when Saudi Arabia was unable to persuade Russia to agree to prolonged and deeper cuts in output. Saudi production is set to exceed 10 million barrels a day next month, according to the people, who asked not to be named to protect commercial relations. Such an increase would amount to more than 3% of Saudi output in February.

“Saudi Arabia is now really going into a full price war,” said Iman Nasseri, managing director for the Middle East at oil consultant FGE.

The collapse of the meeting between the Organization of Petroleum Exporting Countries and its erstwhile partners effectively ends the cooperation between the Saudis and Russia that has underpinned oil prices since 2016. Unshackled from the cartel’s restrictions and with budget holes to fill, there is every chance producers will ramp up output. A reduction in the official selling prices, or OSPs, suggests the Saudis are looking to do just that.

“It’s certainly a high-risk, high-stakes approach,” Tim Fox, chief economist at Dubai-based lender Emirates NBD PJSC, said Sunday in a Bloomberg Television interview. “It will be a question of who blinks first.”

Aramco’s pricing decision affects about 14 million barrels a day of oil exports, as other producers in the Persian Gulf region follow its lead in setting prices for their own shipments. Every month, the Gulf’s biggest producers announce the official selling price for their crude grades as a differential — a premium or discount — against regional benchmarks. The changes are usually measured in cents and, at most, a couple of dollars.

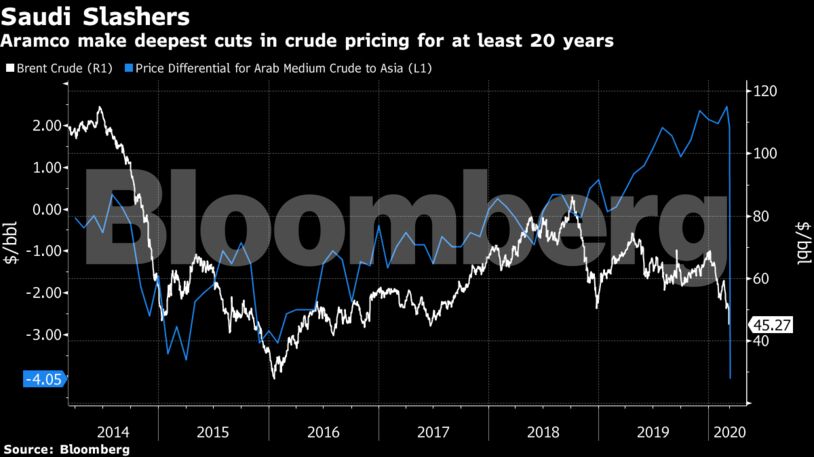

The state producer lowered April pricing for crude sales to Asia by $4 to $6 a barrel and to the U.S. by $7 a barrel, it said in a pricing announcement emailed Saturday just before midnight Saudi time. Aramco didn’t immediately comment on the strategy behind such deep reductions in pricing.

With the coronavirus eroding demand, pushing Brent crude down about 20% so far this year heading into the meeting on Friday, the Saudis had hoped to shore up prices. Brent fell further after Russia balked at OPEC’s plan, closing the week down more than 30% for the year.

Saudi Arabia pumped 9.7 million barrels a day last month, but with the agreement on output cuts expiring at the end of March, the kingdom will be free to produce as much as it wants. The Saudis say they can pump as much as 12.5 million barrels a day.

Aramco slashed its official selling price for flagship Arab Light crude to buyers in Asia by $6 a barrel, to a discount of $3.10 below the Middle East benchmark. The cuts eclipsed the $1.90 reduction expected by traders and refiners. It also reduced Medium crude to Asia by $6 a barrel, dropping the grade to a $4.05 discount, according to the company’s pricing sheet.

Aramco sells most of its crude in Asia, a region that — until the virus outbreak in China — had served as the driver for global growth in energy demand.

The company lowered pricing to northwest Europe and to the Mediterranean region by between $6 and $8 a barrel. Aramco made its biggest cut for crude to northwest Europe, where an $8 a barrel reduction in most grades amounts to a direct challenge to Russia, which sells a large chunk of its flagship Urals crude in the same region. Aramco will sell Arab Light at an unprecedented $10.25 a barrel discount to Brent in Europe.

The world’s biggest oil exporter had expected to announce its pricing on Thursday but delayed the decision until after the meeting on Friday between the OPEC and allies including Russia. The postponement marked the first time in at least a decade that Aramco missed its pricing schedule. It typically announces pricing for its crude on the fifth day of each month.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS