By Stephen Cunningham

“Given current oil markets, this is not the optimal time for the sale,” Jess Szymanski, a spokeswoman for the Energy Department, said in a statement on Tuesday.

The sale from the Strategic Petroleum Reserve was part of a regular drawdown schedule intended to raise $450 million for government programs in fiscal year 2020. That timing came into question after crude slumped on Monday as a price war broke out between Saudi Arabia and Russia, extending losses spurred by the spreading coronavirus.

Bids had been due no later than March 11 and the oil was going to be delivered in April and May.

The decision had been anticipated by analysts including Jim Lucier from Capital Alpha Partners LLC, who said on Monday that “it’s reasonably likely that we can delay or defer the SPR sales until the worst of this is over.”

Last month, the Trump administration proposed selling 15 million barrels of oil from the emergency stockpile as part of its fiscal 2021 budget plan and has previously proposed reducing it by half. The oil reserve, set up after the Arab oil embargo in the 1970s, has also been tapped in response to emergencies, such as Hurricane Katrina.

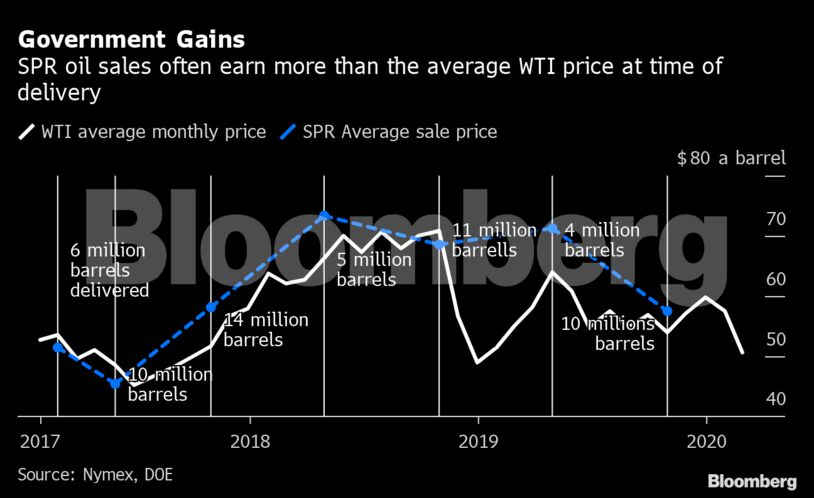

In recent years, sales have generally earned more than the average West Texas Intermediate crude price during the month of delivery, according to Bloomberg calculations. But that doesn’t account for the type of oil the government is selling.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS