By Elizabeth Low and Alex Longley

The travel ban “will undoubtedly further impact demand for oil,” said Jack Allardyce, analyst at Cantor Fitzgerald. “There is clearly scope for wider measures globally, which could further hit underlying demand for oil.”

As oil tumbles, Saudi Arabia is unleashing a wave of crude on Europe, traditionally the backyard for Russian sales, pledging to supply refineries with as much as triple their usual intake from the kingdom. There’s a prospect of a prolonged battle, as analysts from Bank of America Corp. to Raiffeisenbank expect Russia’s low production costs, flexible tax system and free-floating ruble will allow its producers to respond.

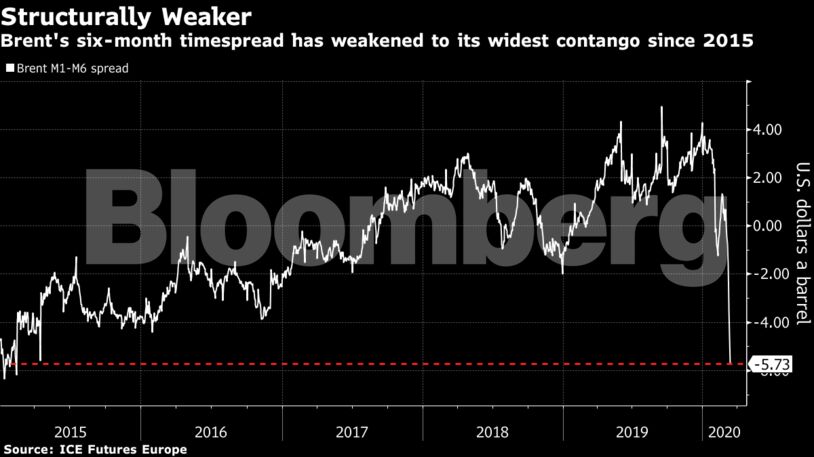

As well as the capitulating structure, the oil market has seen unprecedented levels of volatility. After pulling back from its highest level in data going back to 2010 on Wednesday, a key gauge of WTI fluctuations remains above 100%, still 39 percentage points above a previous record.

While its members flood the market with oil, the Organization of Petroleum Exporting Countries slashed its demand growth forecast for this year on Wednesday by 920,000 barrels a day to 60,000. It could get some relief after the Energy Information Administration forecasts U.S. oil production will fall next year for the first time since 2016 with the price crash already forcing drillers to cut back on capital spending.

| Prices |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS