Helmerich announced capital spending will more than triple to $270 million in the fiscal year that began Oct. 1, far in excess of what analysts were anticipating. The company posted an adjusted quarterly loss of 62 cents per share that exceeded every estimate in a Bloomberg survey.

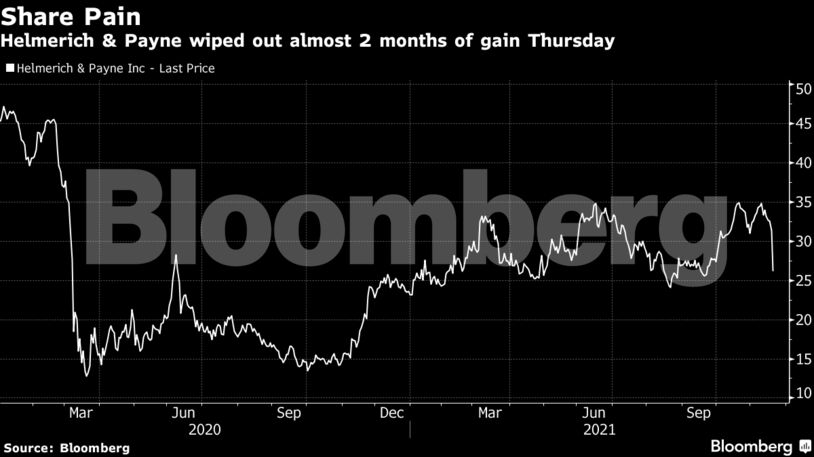

Investors punished the Oklahoma-based company on Thursday, slicing the share price by 16% for the worst one-day drop since March 2020. The fiscal 2022 capital budget “came in a lot higher than anticipated,” analysts at Tudor, Pickering, Holt & Co. wrote in a note to investors. Escalating demand for rigs isn’t translating into improved profitability, according to the note.

Helmerich’s warning follows similar commentary by America’s No. 2 provider of frack pumps, Liberty Oilfield Services Inc., which last month cited “serious” supply-chain issues that have boosted costs faster than they can be passed on to oil explorers.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS