“Oil prices are falling,” Klain said. “Now, when will the industry bring down gas prices????”

And that came just a day after President Joe Biden wrote to the Federal Trade Commission to probe possible illegal conduct in U.S. gasoline markets in a letter in which he expressed concern about the difference between pump prices and the cost of wholesale fuel, while citing what he said was “mounting evidence of anti-consumer behavior by oil and gas companies.”

“I do not accept hard-working Americans paying more for gas because of anti-competitive or otherwise potentially illegal conduct,” Biden said in his letter.

And at a briefing last week Press Secretary Jen Psaki twice pointed to “price gouging” as a reason why prices have stayed high even as oil supplies have risen.

The oil industry rejects they are at fault for gasoline prices that have reached a high not seen since 2014, and, in fact, is at least partly blaming the White House.

“This is a distraction from the fundamental market shift that is taking place and the ill-advised government decisions that are exacerbating this challenging situation,” said Frank Macchiarola, the American Petroleum Institute’s senior vice president of policy, economics, and regulation. “Rather than launching investigations on markets that are regulated and closely monitored on a daily basis or pleading with OPEC to increase supply, we should be encouraging the safe and responsible development of American-made oil and natural gas.”

But the strategy points to the struggles the administration has in addressing surging gasoline prices that have set off political alarm bells within the White House. While presidents have little control over the price consumers pay at the pump, gasoline prices are the most visible form of inflation for consumers, and rising energy costs threaten an economic rebound from the pandemic.

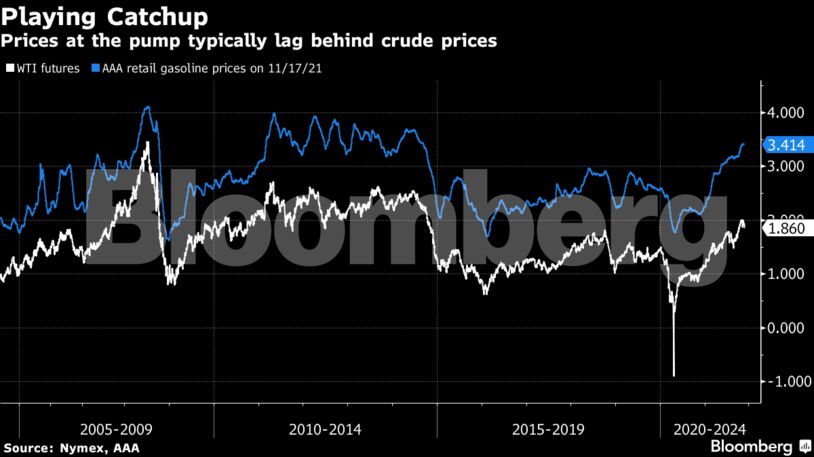

Pump prices often mirror gains and losses in crude oil prices. However, it can take time to materialize as oil trades in the form of futures — reflecting prices for the upcoming month, rather than immediately. So refiners first need to process the crude they already bought at higher prices. In addition, retail prices also include other variables such as taxes, transport and ethanol blending costs.

The jawboning on gasoline prices comes as the Biden administration has been considering an array of options to address the issue with a small group of Biden aides meeting for several weeks. The most likely outcome, analysts say, is unleashing millions of barrels from the nation’s emergency oil cache, the Strategic Petroleum Reserve, though the government’s own Energy Information Administration has said the benefit of that isn’t likely be to be long lasting.

“DOE is continuing to monitor and evaluate tools with WH and agency partners for if and when actions are needed,” the Energy Department said in an email. “No decisions have been made and nothing further to share at this time.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS