Local hospital workers are stopping oil equipment and crews from getting to drill sites in the Neuquen Basin, home to vast shale patch Vaca Muerta, just as winter sets in and Argentina’s natural gas demand surges, which will force the cash-strapped government to import more fuel. The blockades are also disrupting trucking routes to Chile.

Argentina’s government will mix supplies by pipeline from neighboring Bolivia with imports at its two floating facilities for liquefied natural gas and purchases of other liquid fuels for power generation to make up for the shortfall as cheaply as possible, Energy Secretary Dario Martinez said in a statement.

Currently, natural gas production in Neuquen has fallen about 10% from usual levels, but the real impact will be felt in the weeks ahead as drilling stoppages now cause steeper drops down the line. Seventy crews that operate drilling rigs and hydraulic fracturing fleets are unable to work. That’s nearly all the crews in Neuquen, according to the Argentine Oil & Gas Production Chamber.

The blockades are reducing Argentina’s capacity to supply natural gas this winter by 25 million cubic meters a day, the group said. Production in June, the start of winter, has averaged 133 million cubic meters a day in the last three years.

Read More: Biggest Shale Play Outside of Texas Gets $5.1 Billion Lifeline

Buying replacement fuels will weaken Argentina’s trade balance by about $200 million, with that figure rising for every day the protests extend and new wells can’t be drilled, according to company estimates. Argentina needs trade surpluses to jump-start an economy that has been in recession for three years and support its currency, which continues to weaken, contributing to inflation.

There was some good news on Tuesday for shale drillers enduring their 21st day of the blockade, including state-run YPF SA, Chevron Corp. and Royal Dutch Shell Plc, as a group of protesters agreed to wage rises, though non-unionized workers are yet to do so.

Read More: Argentina Prices Jump More Than Expected to 18-Month High

Curtailed production in Vaca Muerta, the world’s second-biggest shale gas formation, showcases how damaging Argentina’s inflation problem is becoming, with the negative impacts spilling over from macroeconomics to commodities as periodic strikes over pay by a slew of trade unions — from soybean processors to tugboat pilots — also hamper the country’s influential agriculture industry. Inflation hasn’t dropped below 36% annually since August 2018.

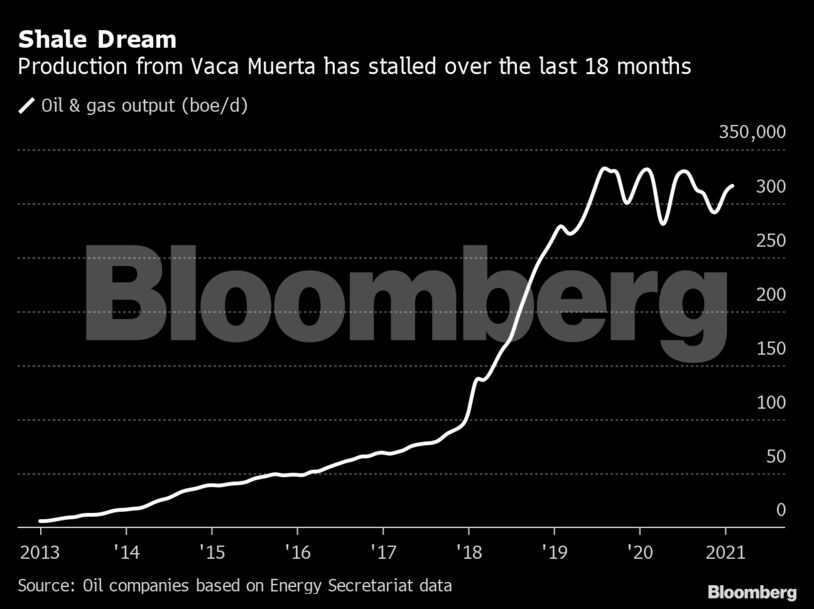

The blockades point to the broader challenges that Argentina faces in Vaca Muerta, where the government wants to mimic the U.S. shale boom. Output before the dispute with the health workers was still just 316,000 barrels a day. In the Permian Basin, drillers are expected to produce 4.6 million barrels a day of crude alone next month.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Busting Biases, Boosting Innovation – Geoffrey Cann