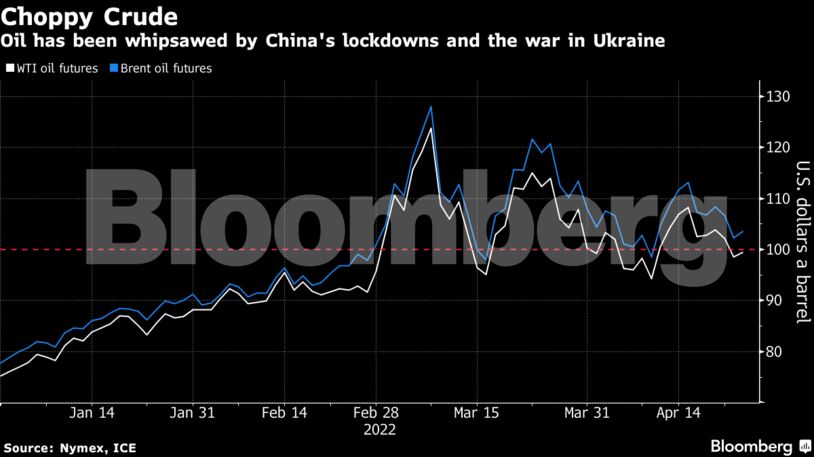

West Texas Intermediate futures lost 0.6%, having earlier risen as much as 1.3%. China’s central bank pledged to increase support for the economy as authorities in Beijing expanded virus testing to most of the city, raising fears the capital could be locked down. Covid’s comeback has hammered fuel consumption in the world’s biggest crude importer.

With near-term prices under pressure, the structure of Brent’s futures curve has weakened significantly in recent days, indicating that concerns about scarce supply have eased. Brent’s prompt spread had its weakest close this year on Monday, a move compounded by softer Chinese demand.

“The key for the market is how the situation in Beijing develops in the coming days and weeks,” ING Bank analysts Warren Patterson and Wenyu Yao said in a note to clients. “The risk is, if we see a similarly protracted lockdown in Beijing to what we have seen in Shanghai, then demand will remain under pressure through May as well.”

| Prices |

|---|

|

Chinese officials on Monday night said virus testing would take place in a further 11 of Beijing’s 16 districts, moving beyond just Chaoyang, where most of the infections have been detected since Friday. A weeks-long lockdown in Shanghai has become more severe, with workers in hazmat suits fanning out to install steel fences around buildings with positive cases over the weekend.

In Russia, Rosneft PJSC failed to award a tender to sell millions of barrels of Urals crude as European buyers continued to stay away due to its war in Ukraine, according to traders. Asian refiners are also shunning the Sokol grade from Russia’s Far East after sanctions were imposed on a tanker company that ships the cargoes.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS