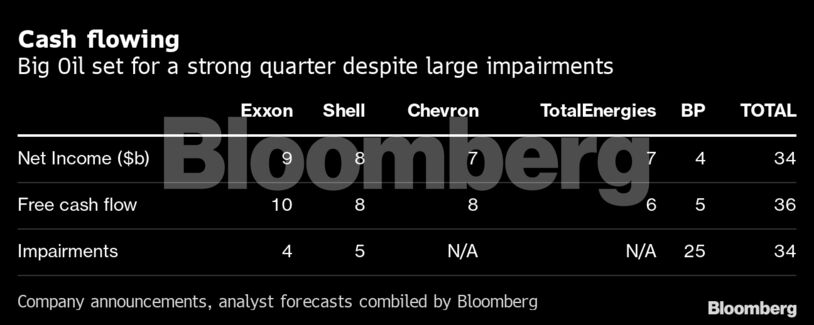

The world’s five largest international oil companies are set to post total net income, excluding the one-time hit from exiting Russia, of $34 billion. That would be the highest since 2011, but could be matched by the combined writedowns resulting from Exxon Mobil Corp. and Shell Plc quitting their Sakhalin oil and gas projects and BP Plc dumping shares in Kremlin-controlled Rosneft PJSC.

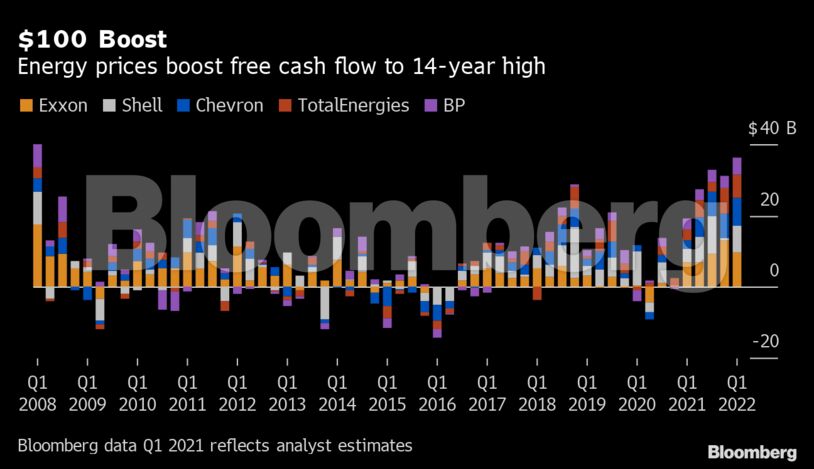

It’s not as bad as it sounds. An accounting loss doesn’t mean money going out of the door today and the figure that really matters for investors — free cash flow — is on track to hit a 14-year high. The outlook for the rest of the year is just as strong.

“The exit from Russia shouldn’t throw the oil industry’s earnings far off track,” said Laura Hoy, an equity analyst at Hargreaves Lansdown. “Oil prices look likely to remain elevated in the near-term as supply tightness persists. This should generally offset the negative impact of ceasing operations in Russia.”

TotalEnergies SE kicks off the reporting season on Thursday, followed the next day by Exxon and Chevron Corp. London-based BP and Shell will post earnings next week. That stands in contrast to their Russian peers, such as gas producer Novatek PJSC, which won’t publish first quarter results.

For the oil majors, the first quarter of 2022 largely put to rest the financial strains of the coronavirus pandemic. After Russia’s invasion of Ukraine, crude oil briefly surged to almost $140 a barrel in London and European natural gas broke records. Prices have eased in recent weeks, but they remain very high as Europe debates the possibility of restricting Russian energy imports.

This puts major oil companies in an enviable position. No more struggling through low prices, slumping demand and ever-growing criticism over climate change. Instead, governments around the world are suddenly desperate to woo energy producers and secure scarce supplies.

In anticipation of better times ahead, Shell, Exxon and Chevron have jumped about 30% this year. But the war in Ukraine still hangs over the industry and shares of BP and TotalEnergies — the companies with the largest outstanding exposure to Russia — haven’t performed so well.

Russian Exodus

TotalEnergies is the only oil major that refuses to quit Russia, where it has a 19.4% interest in gas producer Novatek PJSC and stakes in large LNG projects. Chief Executive Officer Patrick Pouyanne has said that walking out of the country would hand back valuable resources “for free to Mr. Putin,” but the company’s continued exposure stands out.

BP was the first to announce an exit from Russia, but the size of its exposure dwarfs all others. Abandoning its stake of nearly 20% in Rosneft could result in a write down of as much as $25 billion. The London-based company has approached state-backed firms in Asia and the Middle East in search of a buyer.

Shell is talking to possible Chinese buyers of its 27.5% holding in the Sakhalin-2 liquefied natural gas project. Exxon has said it is working on an exit from the Sakhalin-1 oil project. Chevron’s only exposure is through the CPC pipeline, which carries crude produced in Kazakhstan to a port of Russia’s Black Sea coast.

The hit from leaving Russia could turn out to be smaller than the tens of billions of dollars written down in the first quarter.

“It could be that they manage to monetize their assets at higher valuations than the zero value ascribed in the market today,” says Bernstein analyst Oswald Clint. “The surprise with respect to Russia doesn’t necessarily have to be nasty.”

Finding buyers could also be far from straightforward. Russian lawmakers have been considering a bill since early March to set up external administration for key Russian assets owned by companies from “unfriendly states.”

Spending Pressure

Looking beyond the one-time charges related to Russia, Big Oil’s coffers will be swelling. Analysts forecast the five supermajors will generate $36 billion of free cash flow in the first three months of the year, the highest since 2008. That figure, they predict, will rise even further in the second quarter.

So the big question for CEOs may not be the impact of the war in Ukraine, but what they will do with all that cash?

Politicians and consumers would like to see them ramp up investment in new quick-to-produce oil and gas, which could ease current supply shortages or fill a gap created by further sanctions on Russia. But that would overturn companies’ pledges to give their free cash to shareholders.

“Part of the challenge is they made a promise to investors to remain disciplined and deliver returns in the form of buybacks and dividends,” said Matt Murphy, a Calgary-based analyst at Tudor Pickering Holt & Co.

The one area the industry could potentially boost output quickly is U.S. shale, but producers there are suffering from high cost-inflation and a shortage of labor and equipment, particularly in the Permian Basin. “It will be challenging for large operators to bring material production increases beyond their current plans,” Murphy said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS