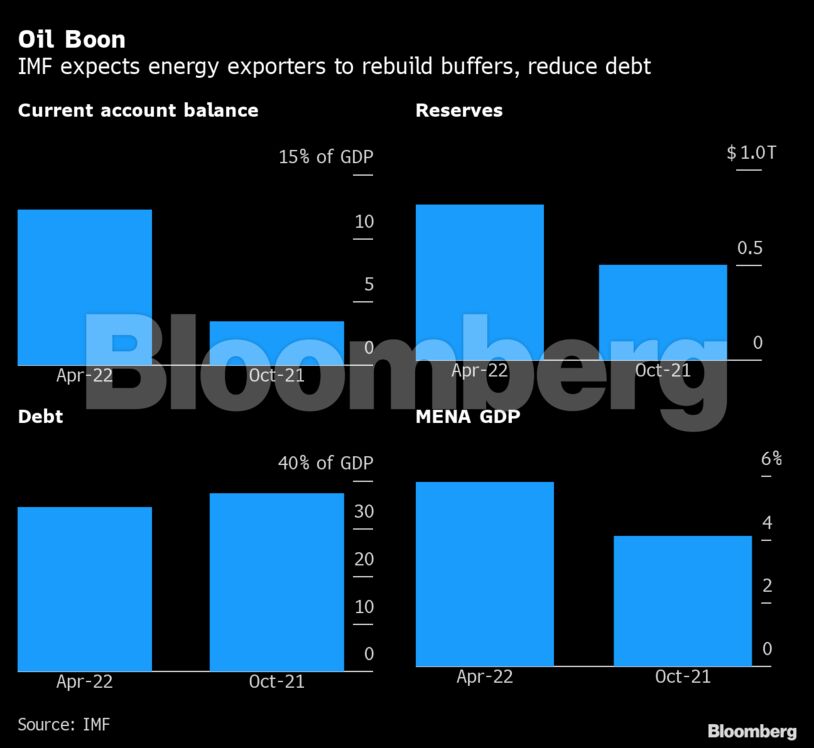

Oil revenue in the region this year will reach $818 billion, an increase of $320 billion from the IMF’s assessment in October, according to its regional outlook published on Wednesday. The Middle East and Central Asia include five of OPEC’s biggest producers led by Saudi Arabia.

“The context of oil prices brings back the memories of the pro-cyclical policies in the past,” Jihad Azour, the IMF’s director for the region, said in an interview. “It is very important for those countries to remain vigilant in the way they conduct their policies.”

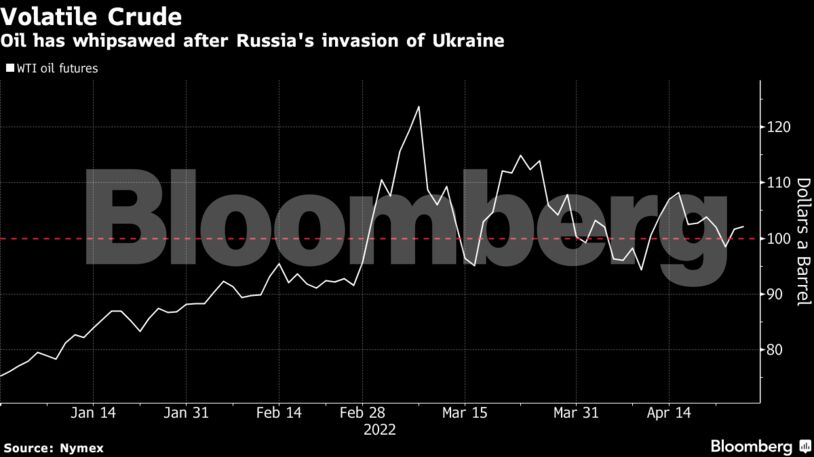

Disruptions in trade and production as a result of Russia’s invasion of Ukraine have driven up the cost of commodities, mostly keeping oil above $100 a barrel since the war began in late February. While putting importers such as Egypt under pressure and raising the threat of longer-lasting inflation around the world, the run-up in energy prices is a boon for governments that rely on sales of crude and gas for most of their budget income.

The IMF said it expects the bonanza “to improve fiscal and external balances” in a region that includes 13 exporters in total — from the United Arab Emirates to Turkmenistan. It predicts oil will average $106.83 a barrel in 2022 and $92.63 next year.

The Washington-based fund estimates official reserves in the region will amount to $1.3 trillion in 2022, an upgrade of about $235 billion from October. Current-account balances are set to improve to 12.2% of output, it said.

The turnaround in public finances caps a period of turmoil for oil producers, after the coronavirus pandemic shut down economies around the world and briefly sent oil prices below zero.

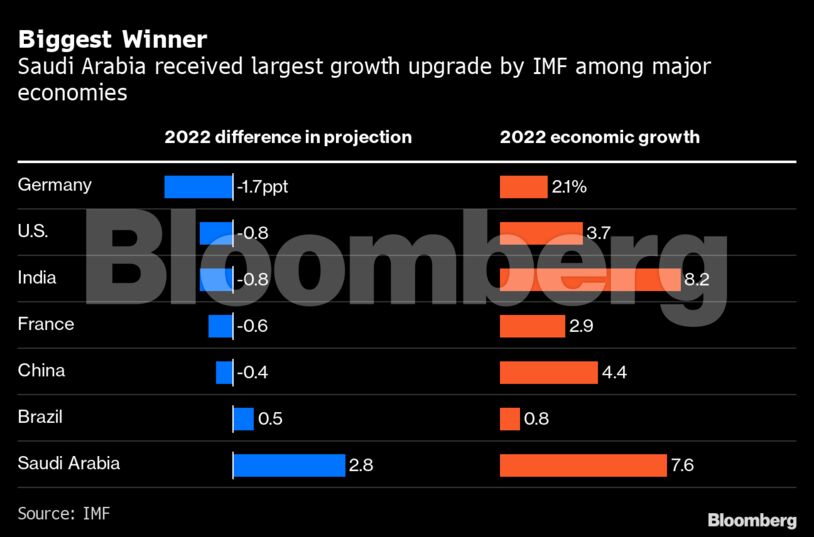

Following a steep downturn, the six members of the Gulf Cooperation Council — Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE — will see economic growth of 6.4% this year, up from 2.7% in 2021.

While the improvement is in large part thanks to a major upgrade for Saudi Arabia, even the weakest Gulf economies are expected to fare better.

Gulf countries should focus on rebuilding buffers and improving their current and fiscal accounts, according to Azour.

What’s more, the oil bounty is “an opportunity to deepen financial markets as well as also to promote additional direct investments in the economy,” he said. This will help “accelerate diversification, create growth that becomes gradually less dependent on oil.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire