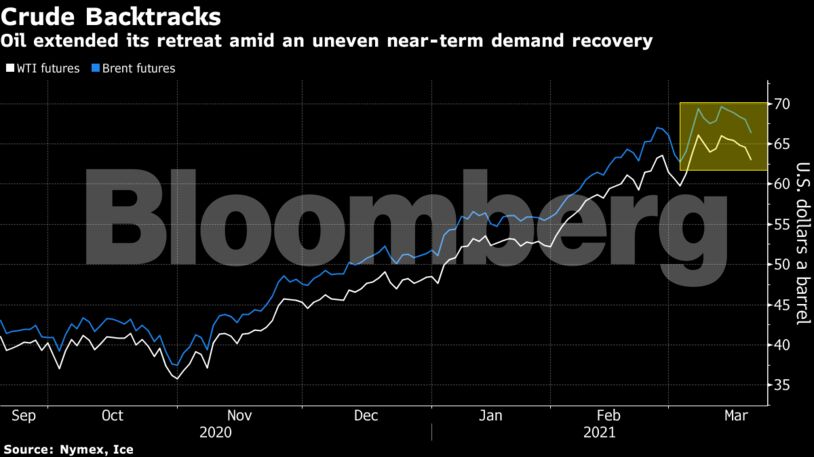

West Texas Intermediate tumbled as much as 4.2% on Thursday. The dollar rose and U.S. equities declined as inflation concerns filtered through broader markets, weighing on oil prices. A stronger dollar weakens the appeal of commodities prices in the currency.

Futures have backtracked after Brent rallied above $71 a barrel and U.S. crude topped $67 earlier this month as the market for physical barrels in Asia shows signs of weakness and a shaky Covid-19 vaccine rollout in parts of the world points to an uneven demand recovery. There’s muted buying from some in China and spot differentials for cargoes to be loaded in April or May from the Middle East and Russia have dipped.

“Demand hasn’t gotten as far back to normal as we expected, with the vaccine news out of Europe definitely concerning in terms of short-term demand,” said Michael Lynch, president of Strategic Energy & Economic Research. “That’s making people think that the time for $70 Brent has not yet come.”

Beyond headline prices, crude’s nearest timespreads are reflecting the fragile near-term outlook. WTI’s so-called prompt spread flipped into a bearish contango last week and Brent’s backwardation — a structure signaling tighter supplies — is weakening.

“The sentiment has changed,” said Tamas Varga, an analyst at PVM Oil Associates Ltd. “Short-term supply and demand considerations are temporarily casting a shadow over the bright future that is likely to arrive in the third quarter of the year.”

| Prices: |

|---|

|

The global recovery from the pandemic remains uneven. Among positive signals, Japan’s government will recommend that the Tokyo area emergency be lifted on March 21. But in Brazil, Covid-19 cases are expanding by record numbers, crimping activity, while in the U.K., delayed imports of the AstraZeneca vaccine will cut supply this month.

| Related Coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS