By Ann Koh and Alex Longley

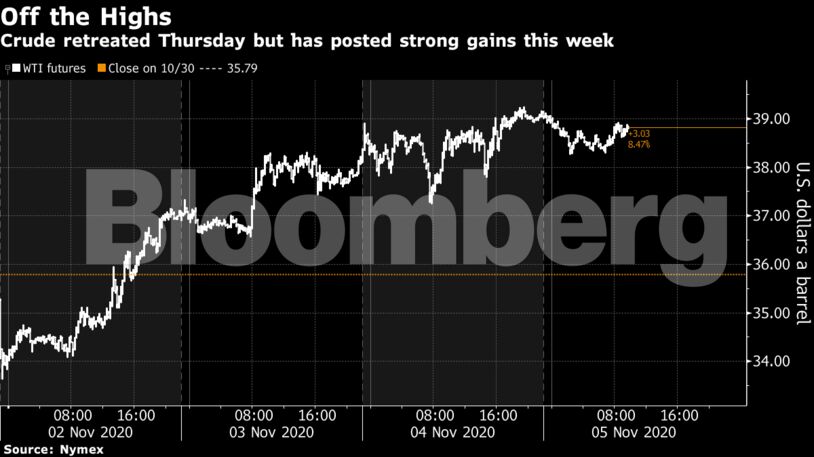

Futures in New York pared an earlier decline with the dollar down 0.6%. Biden needs six more Electoral College votes to claim victory, and with it looking less likely the Democrats will win the Senate, markets were betting there’ll be no major changes to taxes or regulations which have underpinned an equity bull market. Recounts and legal challenges could still lead to a prolonged period of uncertainty though.

Aside from the election, the oil market is now facing up to renewed lockdown measures as a result of Covid-19. Road traffic in some European countries was the lowest since June last week, but Asian demand remains healthier, meaning OPEC and its allies face a test as the group tries to accelerate the oil recovery at its next meeting on Nov. 30-Dec 1.

“Some profit taking amid ongoing demand concerns are weighing a bit on prices,” said Giovanni Staunovo commodities analyst at UBS Group AG.

| Prices |

|---|

|

A nearly 8 million-barrel drop in U.S crude inventories added to the bullish momentum on Wednesday. The Energy Information Administration data suggests stockpiles are rebalancing, although gasoline inventories expanded.

If the current U.S. election trends hold and there’s a divided government, Biden may have to scale back plans to remove subsidies for oil and gas producers, Helima Croft, chief commodities strategist at RBC Capital Markets, said in a note. However, Biden should be able to move forward with plans to re-enter the 2015 Iranian nuclear deal, which could lead to the return of 1 million barrels a day to the market by the second half of next year, she said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS