By Irina Reznik, Olga Tanas, Henry Meyer and Ilya Arkhipov

“We are ready to reach terms with partners within the framework of OPEC+ and are ready to cooperate with the United States on this issue,” Putin said on Friday during a video conference with top government officials and oil executives. “I believe that it is necessary to combine efforts in order to balance the market and reduce output.”

Russia sees a reduction in global oil production of about 10 million barrels a day as possible, and is ready to participate in this “on a partnership” basis, Putin said.

Putin gave Russias’s first confirmation of its willingness to take part in cuts announced by Trump Thursday in a Tweet that drove Brent prices up as much as 47%.

The Kremlin’s reversal reflects alarm at the sudden collapse in demand sparked by the coronavirus pandemic, which threatens a worldwide recession this year. As recently as two weeks ago, Putin was resisting any concessions in the stand-off with Saudi Arabia since Moscow pulled out of a supply-limit agreement with the Organization of Petroleum Exporting Countries over demands for deeper cuts in output. That prompted Saudi Arabia to flood the market with oil, driving prices to an almost two-decade low amid a glut in supply because of a sharp fall-off in consumption.

Putin, who spoke with Trump about the market on Monday, said Russia is in “close contact” with Saudi Arabia. Russia is comfortable with a price about $42 a barrel, and doesn’t want the cost of oil to be “too high or too low,” he said. He indicated that Russia would participate in an April 6 meeting of OPEC and other oil-producing nations.

The output cuts need to last for several months until demand begins to recover from the slump brought on by coronavirus, Energy Minister Alexander Novak said. He lashed out at Saudi Arabia for ramping up production, a move that he said would lead to the “collapse” of the oil market.

Russia and Saudi Arabia could reach a deal to restrict output at Monday’s meeting, according to Andrey Kortunov, director of the Kremlin-founded Russian International Affairs Council.

It’s important that the U.S., the world’s largest oil producer, should participate, Kortunov said. Even if formally the Trump administration can’t commit to private companies scaling back output, it should facilitate that, said Kortunov. The rock-bottom prices have devastated U.S. oil producers, making swathes of the industry uneconomic. Trump is meeting industry officials Friday.

Russia may agree to a three-way arrangement with Saudi Arabia and the U.S., said four people at Russian oil producers. For Putin, the likelihood of all sides making compromises should reduce the risk of appearing weak by agreeing to reduce oil production.

Russia isn’t likely to cut as much as promised, according to Dmitry Perevalov, an oil trader who’s the former vice-president of producer Slavneft.

“Maybe we will cut some oil output but no will be able to check up on it,” Perevalov said. “The price will go up and that’s the main thing for everyone.”

Difficult Times

The efforts that reductions would require are unprecedented and may have negative long-term effects for the oil industry, according to Dmitry Marinchenko, senior director at Fitch Rating.

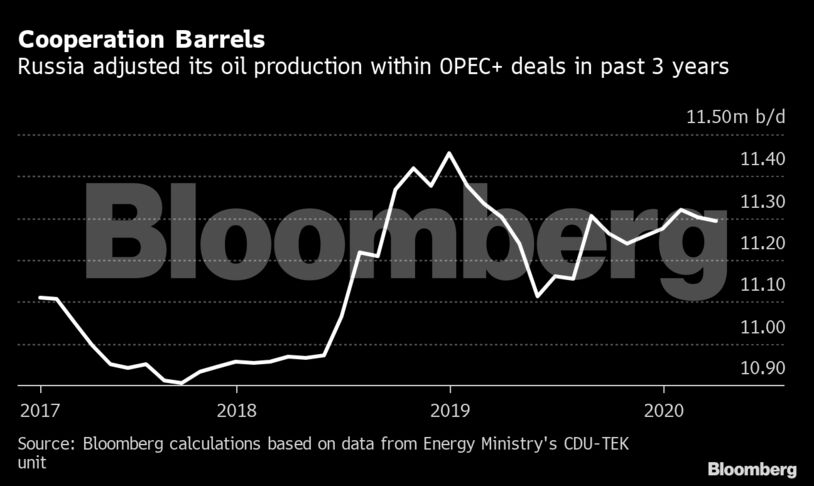

“Under earlier deals with OPEC, Russia has always reduced the output gradually, yet this time around, the cut needs to be made right away,” he said. Producers would probably need to shut down some wells, while reopening wells can be nearly impossible given Russia’s geological conditions, or prohibitively expensive.

Economically, the impact of coronavirus is already wreaking such havoc that any oil deal will at best mitigate the damage. Russia is rewriting its budget to prepare for oil prices at $20 a barrel, according to people familiar with the discussions. Russia will ramp up borrowing by 1 trillion-1.5 trillion rubles ($13 billion-$19 billion) this year as a result, they said.

“If the forecasts of a 15 million- to 20 million-barrel reduction in demand turn out to be right, then no production cut will help raise oil prices,” said Kirill Tremasov, head of research at Loko-Invest in Moscow and a former Economy Ministry official. “The Russian government is doing the right thing, preparing for difficult times and a low oil prices. There are no other options.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS