By Michael Bellusci

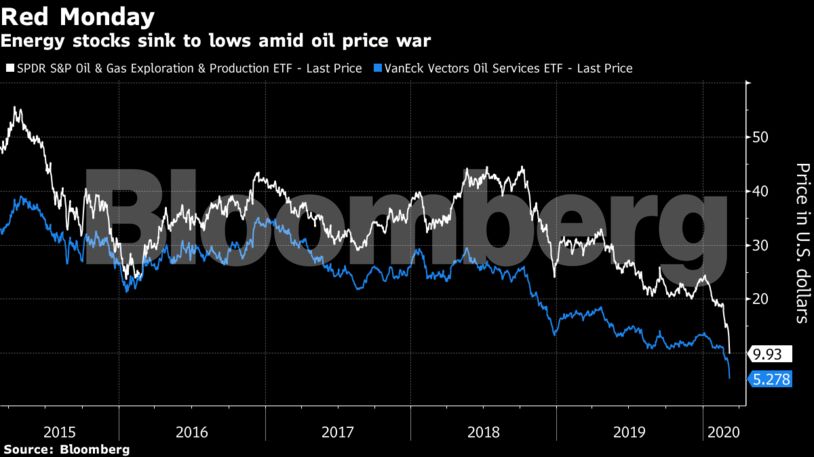

Among energy equities sinking over 50% Monday is SM Energy Co., Callon Petroleum Co., Matador Resources Co., and QEP Resources Inc. Meanwhile, natural gas drillers are rising as analysts see hope for the battered commodity.

Here’s what analysts are saying early Monday:

SunTrust, Neal Dingmann

“We have taken the unprecedented steps of bringing our full coverage group to hold or sell,” calling the situation “energy Armageddon.”

“While there is a chance both could somehow turn around in the coming months, we see little chance of anything materially improving for at least 2-4 months.”

SunTrust’s downgrades include Apache Corp. to hold from buy, Chesapeake Energy Corp. to sell from hold, and Ovintiv Inc. also to sell from hold.

Evercore ISI, James West

The firm lowered ratings on most of its coverage group, while saying “the urgency to consolidate has increased.”

“Prevalent among the stocks downgraded today are the leveraged names without significant backlog,” West said, with cuts to oilfield service companies including Diamond Offshore Drilling Inc. and Apergy Corp.

Evercore maintained outperform ratings on Baker Hughes Co., Dril-Quip Inc., TechnipFMC Plc, Halliburton, National Energy Services Reunited Corp., National Oilwell Varco and Schlumberger Ltd.

Bank of America, Chase Mulvehill

Given the weak environment, BofA chose to downgrade almost all of its oilfield service stocks that weren’t already underperform-rated. Baker Hughes remains the bank’s lone buy-rated service name, while Liberty Oilfield Services Inc. is maintained at neutral.

The bank now carries one buy, seven neutrals and 16 underperforms. Monday’s downgrades include ProPetro Holding Corp. to underperform and Halliburton Co. to neutral.

“So while the near-term looks bleak for US shale, the seeds will be sown for the survivors to enjoy a structurally better oilfield service market.”

E&P analyst Asit Sen also elected to downgrade recommendations on oil producers including Callon Petroleum Co., while Doug Leggate cut stocks including California Resources Corp.

Johnson Rice & Co., Charles Meade

More of the oil-exposed producers are set to take the hardest hit, including Centennial Resource Development Inc. and Denbury Resources Inc., while some of the better insulated E&Ps are Magnolia Oil & Gas Corp. and Northern Oil and Gas Inc.

“Not one company in our coverage can keep production flat for more than a few months while spending within cash flow at $35 WTI,” Johnson Rice said. “Deepwater and other conventional production is not in the cross hairs, but will still take collateral damage to its cash flows.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS