By Jack Wittels and Elizabeth Low

Although crude prices have collapsed due to a price war between Russia and Saudi Arabia, product prices will take longer to catch up. For refiners, that creates a short-lived window where margins get a boost from lower feedstock costs, without a commensurate drop in fuel prices.

“Refiners will get temporary relief from the cheap crude, but any sustained increase in runs will see a worsening oversupply situation in the products markets beyond 2Q after peak turnaround season,” said Sandra Octavia, an oil products analyst at Energy Aspects Ltd.

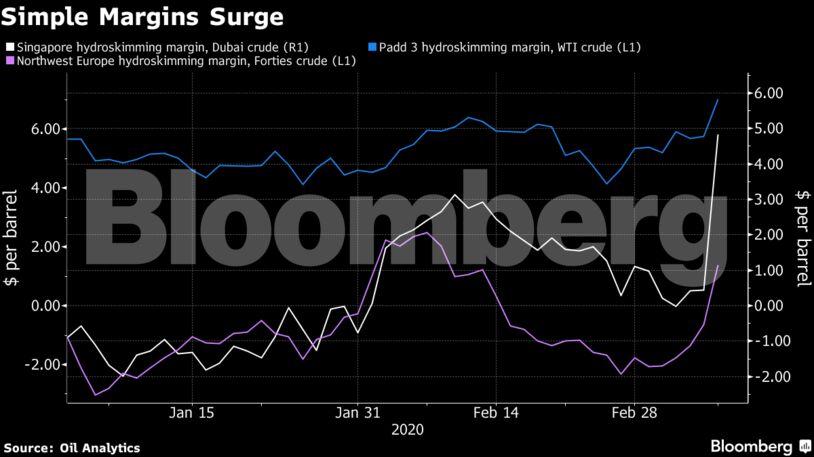

Almost every refining margin rose on Monday as crude futures tumbled, according to data from Oil Analytics Ltd. on Bloomberg. That was to be expected. Sharp moves in crude oil futures markets are rarely mirrored immediately and fully by prices of petroleum products like gasoline, diesel and jet fuel. A look at simple refining margins illustrates the sudden change.

Although cheap oil usually stokes demand, any benefits this time are likely to be outweighed by the coronavirus’ negative impact on consumption as authorities around the world react to the virus’ spread. Refiners in China and South Korea are cutting runs, while diesel shipments from these countries to the storage hubs of Singapore and Malaysia have risen sharply.

“Because of coronavirus, run rates at refineries are under threat,” said Steve Sawyer, director of refining at Facts Global Energy.

Refiners are also facing an ever-more competitive market. More than a million barrels a day of plant capacity is expected to be completed this year, along with close to three million barrels a day next year, according to BloombergNEF. That’s in addition to about 2.5 million barrels a day that was commissioned last year.

Storage Access

For refiners looking to take advantage of the collapse in crude values, much will depend on their access to storage facilities, whether that’s for holding on to crude or having somewhere to put the fuels they manufacture. The run cuts in China and South Korea are a result of plants running out of storage space because demand has been so weak, according to Sawyer.

Russia’s Rosneft PJSC isn’t likely to increase crude production until April, while Saudi Arabia will probably do the same. As a result, there won’t be an immediate change in refiners’ crude slates, Sawyer said. Longer term, the combination of more medium sour crude from those nations — along with potentially less light-sweet oil as U.S. tight oil producers feel the pricing pressure — could result in more high-sulfur fuel oil production.

There’s also perhaps a bright spot: recovery from the virus.

“The number of new coronavirus cases has slowed down in China, and should the economy show signs of recovery it will support margins,” said Victor Shum, vice president of energy consulting at IHS Markit in Singapore.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS