By Heesu Lee and Alex Longley

Oil is down for the week after plunging 4.8% on Tuesday, its worst decline on the day of an OPEC meeting in more than four years. While the group’s Secretary-General Mohammad Barkindo described the drop as an “anomaly,” Bank of England Governor Mark Carney warned of dangers from rising protectionism around the world and said there could be a “widespread slowdown” that may require a major economic-policy response.

“The OPEC deal was more or less what the market deemed to be necessary,” said Ole Sloth Hansen, head of commodities strategy at Saxo Bank A/S. “The weakness in U.S. and Chinese data early in the week, together with yesterday’s smaller-than-expected draw, only added to demand worries.”

West Texas Intermediate oil for August delivery lost 22 cents, or 0.4%, to $57.12 a barrel on the New York Mercantile Exchange as of 10:28 a.m. London time. The contract gained $1.09 on Wednesday, recovering some ground after slumping the most since May 31 in the previous session.

Brent for September settlement declined 7 cents, or 0.1%, to $63.75 a barrel on the ICE Futures Europe Exchange, after adding 2.3% on Wednesday. The benchmark global crude traded at a premium of $6.50 to WTI for the same month.

See also: U.S. Oil Inventory Buildup Is Looking Increasingly Gassy

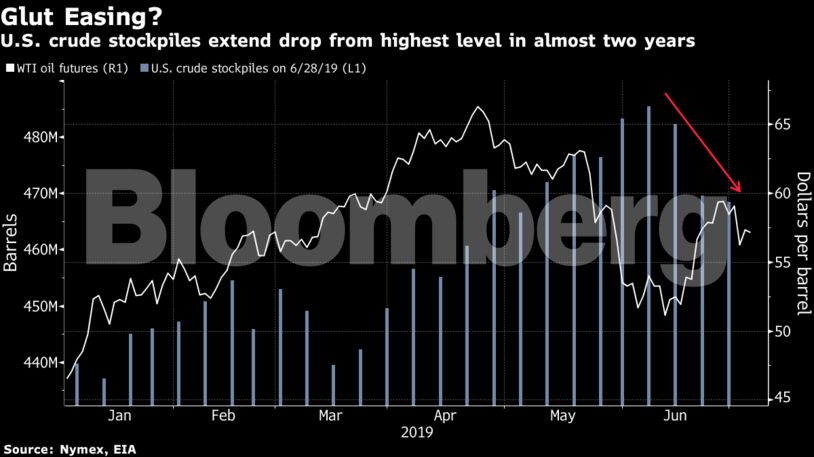

U.S. crude inventories shrank by 1.09 million barrels last week, according to the Energy Information Administration. The Bloomberg survey had predicted a loss of 3 million barrels. Gasoline stockpiles fell by 1.58 million barrels, compared with a forecast for a 2.4 million-barrel loss.

U.S. oil production also remains near a record-high. Output increased to 12.2 million barrels a day last week, resuming gains after dropping since the start of June, the EIA said. Crude exports from the country fell back to below 3 million barrels a day.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS