(Bloomberg)

Energy bills for European households will surge by 2 trillion euros ($2 trillion) at their peak early next year, underscoring the need for government intervention, according to Goldman Sachs Group Inc. utilities analysts.

At their height, energy bills will represent about 15% of Europe’s gross domestic product, the analysts, led by Alberto Gandolfi and Mafalda Pombeiro, wrote in a note dated Sunday.

“In our view, the market continues to underestimate the depth, the breadth and the structural repercussions of the crisis,” they wrote. “We believe these will be even deeper than the 1970s oil crisis.”

Stock investors are too pessimistic about the effect of regulatory efforts, Goldman said. Some of the steps being considered — including price caps and a so-called tariff deficit — could ease the overhang on stock prices by smoothing the increase in tariffs, limiting the near-term drop in industrial production, and largely defusing regulatory risk, the analysts wrote.

The increase in energy bills has prompted a rush by governments to ease cost pressures on households and businesses. EU energy ministers will meet Friday to discuss measures including natural gas price caps and suspension of power derivatives trading. France and Germany support windfall taxes on energy profits.

The introduction of price caps in power generation could save the bloc around 650 billion euros in power bills and offer consumers and markets some relief while allowing governments to forgo a windfall-profits tax, the Goldman analysts said.

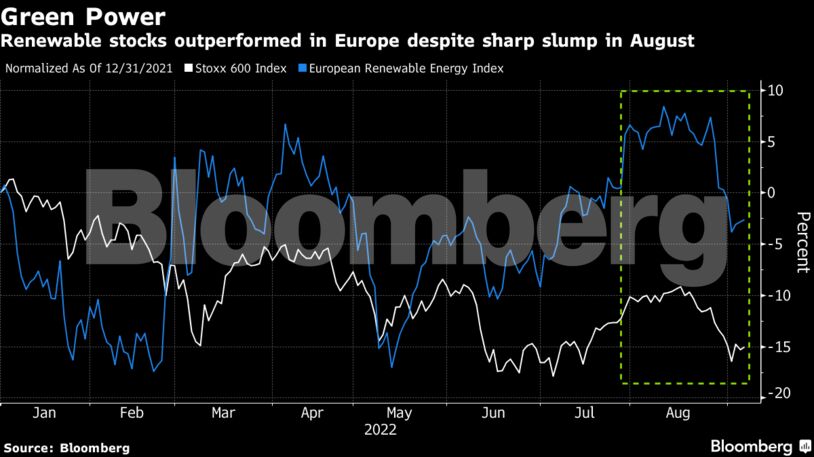

Investors should favor shares in companies that are developing renewable-energy sources, since they should benefit from structurally higher-for-longer energy prices, the analysts wrote, highlighting RWE AG, Energias de Portugal SA and Orsted A/S.

Price caps wouldn’t fully solve the affordability problem, meaning a tariff deficit might be needed to spread the spike in bills over 10-20 years, Gandolfi and Pombeiro said. Utilities would need to be able to securitize those future payments, allowing them to avoid an excess burden on their balance sheet.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS