“There are clear supply issues facing the market, which will keep the oil balance tight for the remainder of the year,” said Warren Patterson, head of commodities strategy at ING Groep NV in Singapore. Investors are “dealing with plenty of uncertainty and trying to find direction,” he said.,

Oil has been gripped by bouts of volatility amid low liquidity recently as investors juggle competing supply and demand outlooks. In 78 trading days since the start of April, WTI volumes have only been above the 200-day average on six occasions, underscoring the relative lack of activity in the market.

The Federal Reserve is expected to approve another big interest-rate hike on Wednesday to combat surging inflation, escalating fears that the US is heading toward a recession.

WTI is still up almost 30% this year, in part due to upended trade flows from Russia. The gap between the US benchmark and Brent has widened to almost $9 a barrel, indicating supply tightness is more pronounced in Europe than the US. American gasoline demand has also eased.

| Prices: |

|---|

|

The tight market may get some relief from recovering Libyan output but the country’s contribution will probably be volatile given the potential for conflict and unrest to flare quickly. Supply from the OPEC producer has climbed back above 1 million barrels a day.

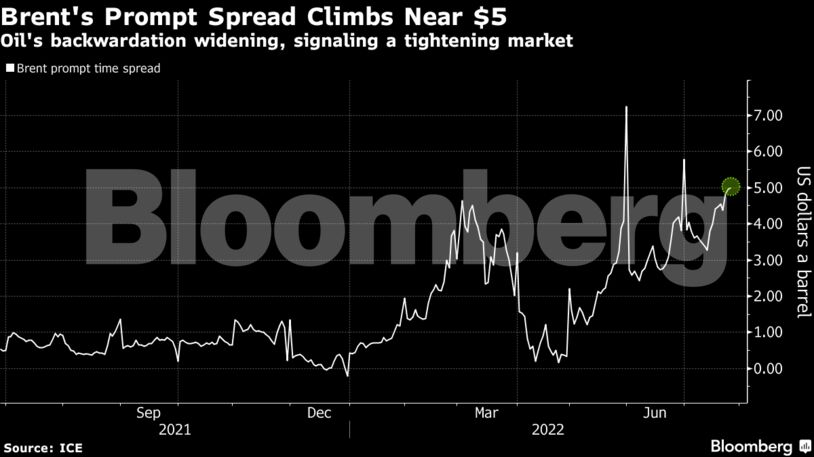

The market is steeply backwardated, a bullish pattern marked by near-term prices commanding a premium to later-dates ones. Brent’s prompt spread was $4.96 a barrel in backwardation, compared with $3.83 at the start of July.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS