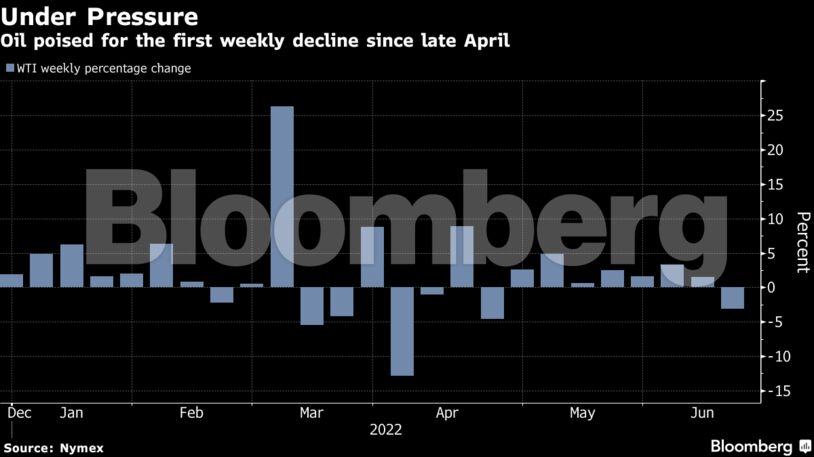

Oil is heading for its first weekly decline since April after a period of choppy trading as investors weigh the prospect of further monetary tightening from central banks to curb rampant inflation.

West Texas Intermediate was trading near $118 and is on track for a 1.6% decline this week. Federal Reserve Chair Jerome Powell this week openly endorsed for the first time raising interest rates well into restrictive territory, a strategy that’s often resulted in an economic downturn. The bank hiked rates the most since 1994 on Wednesday to combat inflation.

Russia’s invasion of Ukraine has compounded global price rises and helped to drive up the cost of everything from food to fuels. US retail gasoline prices have repeatedly broken records and the national average recently topped $5 a gallon. The White House is weighing limits on fuel exports to try and alleviate the pump pain.

“Oil markets have focused on macro this week,” said Keshav Lohiya, founder of consultant Oilytics. “However, we wonder what 25 basis point or even 50 basis point increases will do when the bulk of the inflation is coming from commodities.”

Crude is still up more than 50% this year as rebounding demand combined with upended trade flows from Russia to squeeze the market. Prices could withstand an economic slowdown because supplies are tighter than other recessionary periods, S&P Global Inc. Vice Chairman Daniel Yergin said this week.

| Prices |

|---|

|

As the war in Ukraine continues, focus remains on just the extent to which Russian oil flows will be altered. On Friday, the country’s Deputy Prime Minister Alexander Novak said throughput at the nation’s refineries could fall 10% this year.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS