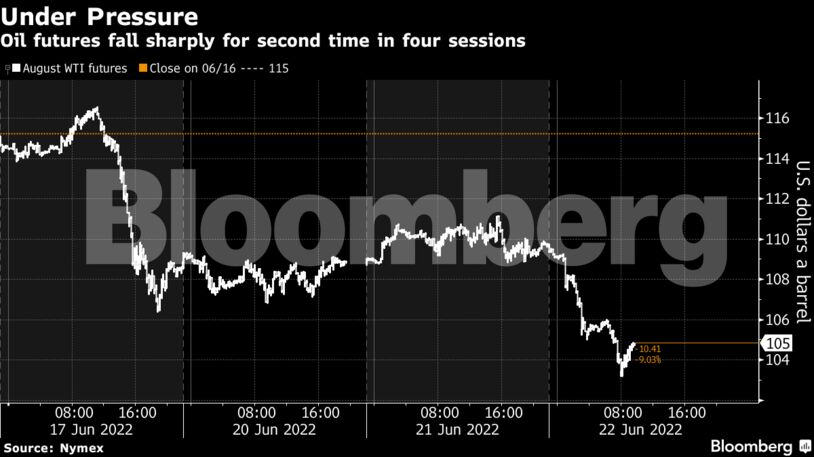

West Texas Intermediate tumbled toward $104 a barrel. Investors are concerned about the impact of sharply higher US interest rates and Federal Reserve Chair Jerome Powell is due to testify before Congress Wednesday on his bid to curb inflation raging at the fastest pace in decades. Inflation is also raging outside the US, with UK price rises hitting a fresh 40-year high.

Since a spike after Russia invaded Ukraine, oil markets have been grappling with a liquidity crisis with futures holdings falling to the lowest since 2016, leaving headline prices prone to outsized swings. The U.S. crude benchmark also fell below its 100-day moving average early on Wednesday for the first time since January, adding technical pressure to an already fragile market.

While crude has been shaky over the past week, plunging 6.8% on Friday, there’s little respite to the tightness in refined fuel markets. US President Joe Biden will call for a gasoline tax holiday, a person familiar with the plan said, after the average US retail price topped $5 a gallon this month following a surge of more than 50% in 2022.

Oil is headed for its first monthly loss since November as concerns about an economic slowdown offset the fallout from the war in Ukraine. Super major Exxon Mobil Corp. warned this week that crude markets may remain tight for years, while Vitol Group, the world’s largest independent oil trader, flagged rising fuel demand in China. At the same time, soaring margins are offering refineries an incentive to buy every barrel of crude they can get.

“Broader macro influences have been dictating price direction for oil recently,” said Warren Patterson, head of commodities strategy at ING Groep NV in Singapore. “However, fundamentally the market still remains constructive. The oil balance is set to be tight for the remainder of the year, while in the shorter term strong refinery margins should be supportive for crude demand.”

| Prices: |

|---|

|

Wednesday’s slide came as other commodities also lost ground, as well as risk assets more broadly. Copper and iron ore both declined, as did equities. An additional headwind for crude prices came from a rising dollar, which makes imports more costly for holders of other currencies.

“Investors should remember that Fed-induced slowdowns are simply a short-term abatement of the symptom – inflation – and not a cure for the problem – underinvestment,” Goldman Sachs Group Inc. said in a note.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS