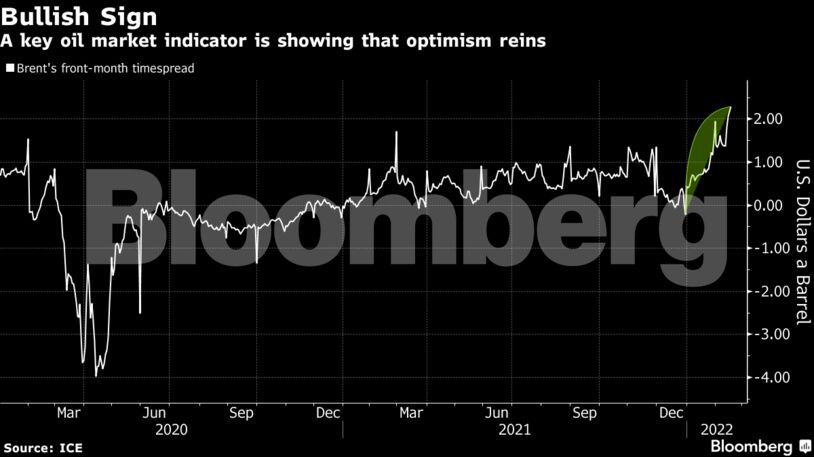

The premium of Brent oil’s front-month contract to the second month — known as prompt timespread — expanded further after reaching the widest bullish backwardation structure since 2019 earlier this week. Spreads are typically a good indicator of underlying supply-demand dynamics, while individual futures contracts can gyrate on jitters including geopolitical risks.

Physical oil markets across the world have tightened as stockpiles dwindle and consumption rebounds. While American producers are boosting output as futures near $100 a barrel, OPEC+ suppliers are consistently falling behind their output targets. Demand has improved as more economies reopen, though energy costs and inflation may soon rise to levels that erode use.

Brent’s six-month and one-year timespreads were also showing a sharp jump to multi-year highs this week, data compiled by Bloomberg showed, with similar trends seen for West Texas Intermediate crude.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS