The bullish outlook was shared by Saudi Aramco boss Amin Nasser, who delivered a speech in Riyadh. “With the global recovery we’re seeing today, there is more demand for products and we see that from different enclaves, especially in Asia,” he said.

Traders are also closely watching the situation in Ukraine. Any attack from multiple locations could essentially fence the country in, potentially upending commodity markets if regional flows are disrupted and possibly targeted by Western sanctions.

The Kremlin said there are “no concrete plans” for a summit between U.S. President Joe Biden and Russian President Vladimir Putin, throwing into question the fate of a French proposal that seemed to offer fresh optimism for averting any possible attack on Ukraine.

The U.S. told allies that any Russian invasion would potentially see it target cities beyond the capital, Kyiv. Moscow, which has strenuously denied it plans an invasion, said over the weekend that its forces would remain in Belarus indefinitely.

“The concern is that if tension in Eastern Europe escalates further that some of this supply might get disrupted intentionally or driven by political divisions,” affecting not only energy but other commodities, said Giovanni Staunovo, a commodity analyst at UBS Group AG. “I would expect the market to continue to react in a sensitive way.”

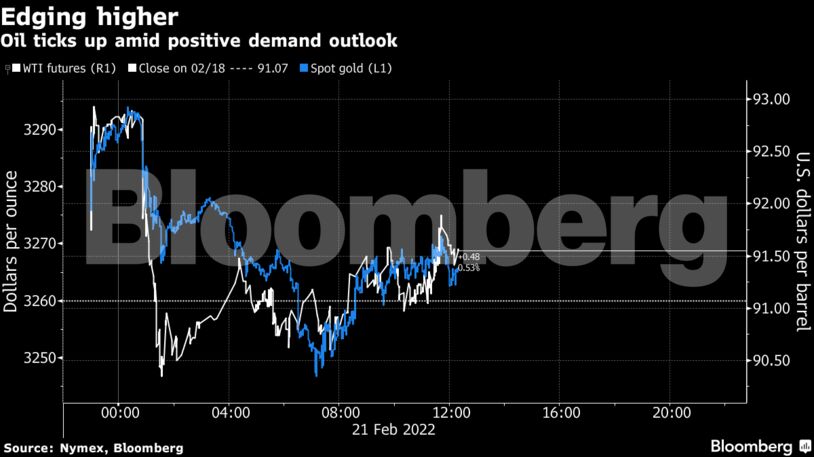

| Prices |

|---|

|

Natural gas prices fell sharply on the prospects of a Biden-Putin summit.

Oil investors are also following negotiations to rekindle Iran’s 2015 nuclear agreement, which has made some progress, Iran’s Foreign Ministry Spokesman Saeed Khatibzadeh said in a press conference. Though the remaining issues are the hardest ones, he added.

In a signal of the crude market’s bullishness, nearby contracts for WTI and Brent are commanding significant premiums over those further out, indicating that traders are clamoring for barrels right now. In Asia, refiners are seeking to ramp up their run rates to benefit from healthy margins.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS