Mounting speculation that Iran’s nuclear deal may be revived, potentially paving the way for the removal of U.S. sanctions on the nation’s crude exports, is damping some of the bullish signals. The oil market’s structure weakened markedly on Friday, and one oil-focused exchange-traded fund saw its biggest withdrawal since July 2020.

Still, geopolitical tensions over Ukraine continue to run high. Prices of commodities from gas to metals and food have swung this week with every twist and turn in the standoff between the West and Russia.

After the U.S. ramped up warnings of a possible Russian attack on Ukraine, Russian officials said no invasion of Ukraine was underway and none was planned. U.S. Secretary of State Antony Blinken and Russia Foreign Minister Sergei Lavrov have agreed to meet for talks next week.

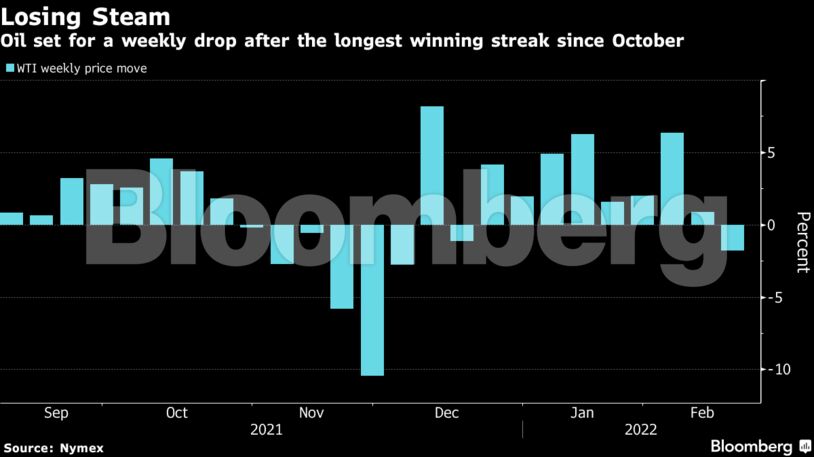

Crude rose to the highest since 2014 this week in a blistering rally underpinned by roaring demand, constrained supply, and declining inventories. Prices in London at one point rose past $96 a barrel and analysts forecasts for $100 intensified. But that’s now eased off. Earlier this week, Tehran’s top negotiator, Ali Bagheri Kani, tweeted that efforts to restore the nuclear deal are “closer than ever” to an agreement.

“The Ukraine crisis is taking a back seat to the prospect of Iranian barrels flooding the market,” said Stephen Brennock, an analyst at brokerage PVM Oil Associates. “For all the talk of war and conflict, market players remain unconvinced. This is perhaps why the geopolitical risk premium is starting to wane.”

| Prices: |

|---|

|

Issues surrounding Iran’s nuclear accord are set to be discussed at a key transatlantic security meeting in Munich this weekend. A lifting of sanctions on oil shipments from the Persian Gulf producer would be a later phase of the agreement, Reuters reported, citing a draft text and unidentified diplomats.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS