By Geoffrey Cann

Most, if not all, large energy companies now include climate change as a critical topic on the Board agenda. As managers, you may be wondering what your business can do about it. Here are some digital tools that can help.

The Dilemma

It’s possible to hold two opposite ideas at once and still function.

On the one hand, I accept the science of climate change and that human activity, particularly the burning of fossil fuels, is having an effect on the climate.

In 1994 I spent a short two week vacation on Magnetic Island which is just off shore of Townsville, north Queensland, and took a day trip snorkeling on the Great Barrier Reef. I have vivid memories of gigantic clams 4 feet across, of vast schools of fish, of the constant crunching of parrotfish eating coral, of lingering after a sea turtle through acres of deep coral fiords.

I then visited Cairns on two separate trips, in 2003 and again in 2014, with trips to Green Island each time. By 2014, I was staggered at the extent of the coral loss. The ocean floor was grey with dead coral. The color had all gone. The fish population seemed to have diminished to just a few stragglers.

The reef is my canary in the coal mine. The current iteration of the reef is about eight thousand years old, and developed following the last Ice Age. And now it is vanishing. It needs hundreds of years to return to its 1994 glory.

The next generation of consumers are convinced of climate change, and they’re now exercising their choices by protesting, walking out of school, and pressuring universities to divest of fossil investments. Oil executives lament the lack of interest in the industry from their own kids.

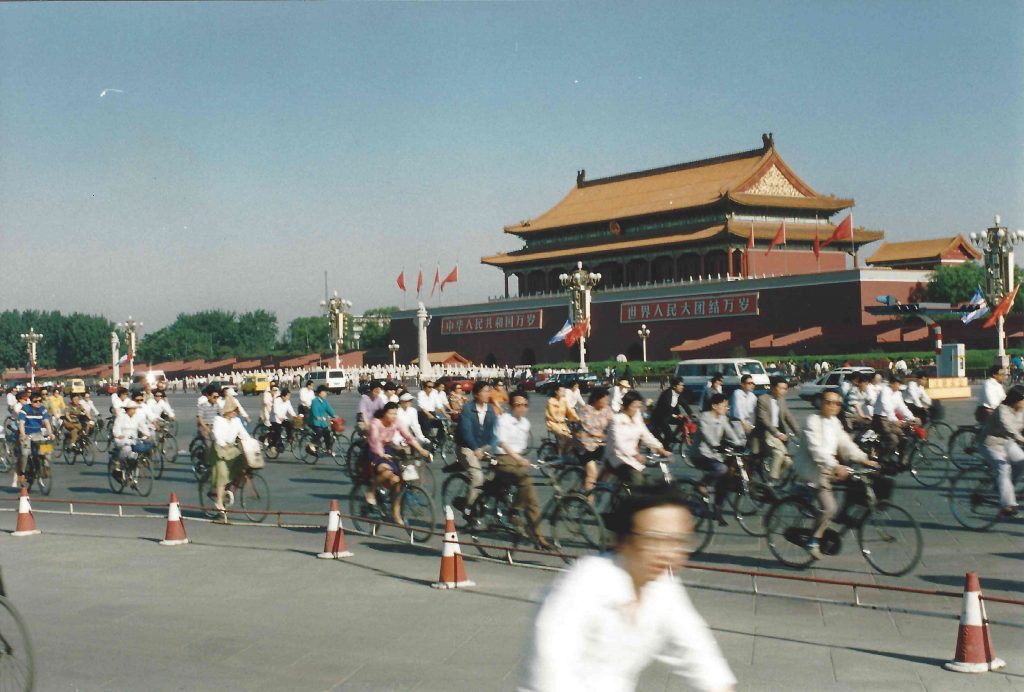

On the other hand, I also observe that the fossil fuel industry has been instrumental in bringing prosperity to much human existence, by bringing light to the dark, heat to the cold, and force to the inert. From 1993 to 1995, I worked regularly in China, and my photos from that time are very revealing — blue skies, bicycles everywhere, no cars, no street lights, and door to door coal delivery by donkey cart. Coal plus iron ore plus oil has lifted 500m people out of poverty by rapidly improving the performance of the agricultural, transportation and manufacturing sectors.

Another 500m people await their opportunity to enter the middle class, but perhaps at the expense of irreversible damage to our earthly garden of eden.

I hold these two conflicting ideas at the same time, that the very thing that has lifted us into prosperity, comfort and flourishing is also threatening our climate.

Progress Blockers

Businesses everywhere are (or will be) tasked with figuring out a new balance between our use of energy, the economies that power our lifestyles, and our impact on the natural environment—the Triple E, or EEE for short.

Societies are now woke to the balancing act of EEE. During the pandemic, economies suffered hugely, energy demand tumbled, while in the environment the skies became bluer and the water clearer.

Assume that the environment is the reactive participant of this trio—the environment reacts to how we create and use energy, and how our economies consume our resources to sustain our life styles. It falls to humans to manage proactively the energy and economy elements of the triple E.

According to Dr Aseem Prakash of the University of Washington, there are 4 challenges that society faces as it aims for that new balance:

THE TRAGEDY OF THE COMMONS

The costs of making changes to our energy use, or to our economies through regulation or taxation are localized to specific jurisdictions, but the benefits accrue globally beyond our borders. GHGs inconsiderately ignore national borders. We can clean our air in Canada, but what’s the point if China doesn’t follow suit?

THE FAIRNESS EQUATION

The consequences of choices in energy use or how our economies operate penalizes some segments of society while benefiting others. We can tax fossil fuels to encourage energy diversification, but that penalizes construction workers who are entirely dependent on diesel fuel for their equipment and for whom alternative equipment doesn’t exist.

FLAGRANT HYPOCRISY

We signal how virtuous we are as we recycle or we embrace the 100 mile diet, while we strive to live in splendid pandemic isolation in our new large monster homes, and drive our Ford 150’s to buy groceries. Serious climate change must be someone else’s problem.

THE AGENCY PERCEPTION

We tell ourselves that any personal contribution we make to solve the climate problem doesn’t matter because tiny changes are irrelevant. China emits the same quantity of GHG as Canada every 25 days. Cut your business GHG emissions by 50%, and so what?

What can we do?

Actor Choices

The actors in our EEE equation have limited levers to pull to drive change, and here’s just a few to consider.

GOVERNMENT ACTIONS

To change social behaviors in an economy or in energy use, governments can create a price signal by imposing a carbon tax, or by implementing a cap and trade market, or by regulating for emissions.

NGO MOVES

To maintain pressure on the other actors, non governmental organizations (NGOs) can maintain registries of big emitters, conduct ‘Name and Shame’ campaigns, pressure investors to decarbonise their portfolios, intervene in energy and economic proposals, and litigate for change.

BUSINESS CHANGES

Businesses can embrace carbon pricing, adopt carbon accounting alongside other measurements, implement voluntary greening programs, and transform their supply chains. Financial institutions can withdraw funding for fossil fuels. Universities can discontinue their education programs in the petroleum studies, and emphasize renewables.

PERSONAL ACTIONS

And what about the rest of us? We’re encouraged to go vegetarian (as meat is one of the most egregious carbon sources), adopt electric transportation (if it’s available), put solar panels on your house (if you have an idle $15000 that might never pay off), fly less (no more sunny holidays), and put on a sweater.

The Digital Response

In a race between fossil fuels and technology, technology is going to win. Technology is surfing Moore’s Law of exponential improvements, while fossil fuel energy plods along with marginal gains. Eventually, as technology is applied to the EEE challenges, it will find winning solutions.

HIGH IMPACT

These are the levers for carbon management that are highly susceptible to digital innovation.

EMISSIONS TRACKING

If you’re in industry, you’ve seen those annoying inspirational posters on meeting room walls, with a bracing picture of a racing yacht or a pit crew, underwritten with some syrupy business truth about measuring things.

- What gets measured gets rewarded.

- You can’t fix what you can’t measure.

- In God we trust. Everyone else, bring data.

- Subjectivity measures nothing consistently.

- If you can measure it, it’s not love.

None of the standard energy SCADA systems of the past were designed for emissions tracking. Emissions were not a thing. Adding an army of expensive engineering talent or management accounting people to measure emissions is not plausible for many companies and industries. This is a job for automation — internet of things and analytics.

CARBON TRADING AND CREDIT TRACKING

Inventing credits for carbon emitted and not emitted, pricing those credits, enabling the trading of credits—only an economist could come up with such an elegant answer that combines everything you don’t understand about cryptocurrency and NFTs, with everything you don’t understand about green house gases. Blockchain could be the solution to uniquely identify a carbon credit so that it’s not counted twice, and manages the credit through its life cycle of purchase, sale, exchange, and disposal.

WORKING FROM WHEREVER

I was on a call this week with a conference organizer who is putting together his first live event in over 2 years. Like me, he has worked throughout the pandemic without needing a suit and tie, pressed shirts, and even shoes. For a big segment of society, going back to the office grind of commuting, overly engineered schedules, expensive clothes and cosmetics is suddenly very unappealing.

Cloud computing, encryption tools, collaboration technologies, gamification, augmented reality, AI and other digital tools showed the world that many workers can work from wherever they happen to be, rather than in the office of the past.

AUTOMATION OF EQUIPMENT

There’s a lot of driving about in oil and gas because the assets in the industry are spread out. Just for fun, use Google Earth to zero in on Odessa Texas and check out all the oil wells, far from civilisation. The industry really needs smarter assets that self manage, using the data from their own sensors and interpreted by their on-board artificial intelligence engines. This will trim the requirement for people to drive long distances (a carbon intense activity) to visually inspect the equipment, check fluid levels, record data from gauges and carry out routine maintenance.

SUPPLY CHAIN GREENING

I’ve been involved in hundreds of supply chain businesses, and in the past, carbon has rarely factored into any thinking about the design of the supply chain.

The pandemic has shown just how delicate and sensitive our global supply chains are to disruptions. It’s been reported that ship transits from China to the US are now over 114 days, vs 65 before the pandemic. Additive manufacturing will be one of the key digital tools that helps industry rethink the supply chain design with carbon in mind.

LOW IMPACT

These are the levers for carbon management that are not as susceptible to digital innovation, and may be addressed using existing tools.

CARBON ACCOUNTING

With a handle on actual emissions, the next step is to account for the emissions—volumes, intensity, timing, source activities. The accounting enables the accountability, or the pressure on someone to act on the accounting. The business gene for making things better kicks in, with plans, budgets, targets, timetables, penalties, and rewards. All of these are presently available in abundance in most businesses.

CARBON PRICING

A sure way to get managers to pay attention to something is to give it a cost. They can then weigh up where to invest to yield the best cost or productivity outcome. Managers don’t need a real carbon price to take action. They can equally use a phantom price or a shadow price.

SWEATERS

Finally, lower the thermometer and put on a sweater.

Conclusions

The EEE formula has been drifting out of balance for decades. More than ever, we need to turn to technology to help us strike a new more sustainable balance.

This article first appeared on March 25, 2019, and is remarkably still on point.

Check out my book, ‘Bits, Bytes, and Barrels: The Digital Transformation of Oil and Gas’, coming soon in Russian, and available on Amazon and other on-line bookshops.

Sign up for my next book, ‘Carbon, Capital, and the Cloud: A Playbook for Digital Oil and Gas’, coming March 15, 2022.

Take Digital Oil and Gas, the one-day on-line digital oil and gas awareness course on Udemy.

Mobile: +1(587)830-6900

email: [email protected]

website: geoffreycann.com

LinkedIn: www.linkedin.com/in/training-digital-oil-gas

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS