Crude’s gains came against the backdrop of surging gas and power prices in Europe, with France even burning fuel oil in a bid to keep the lights on. The oil market got a boost from expectations that there would be a major switch in power consumption toward crude and petroleum products earlier in the year, and natural gas prices in Europe were above $300 a barrel of oil equivalent on Tuesday.

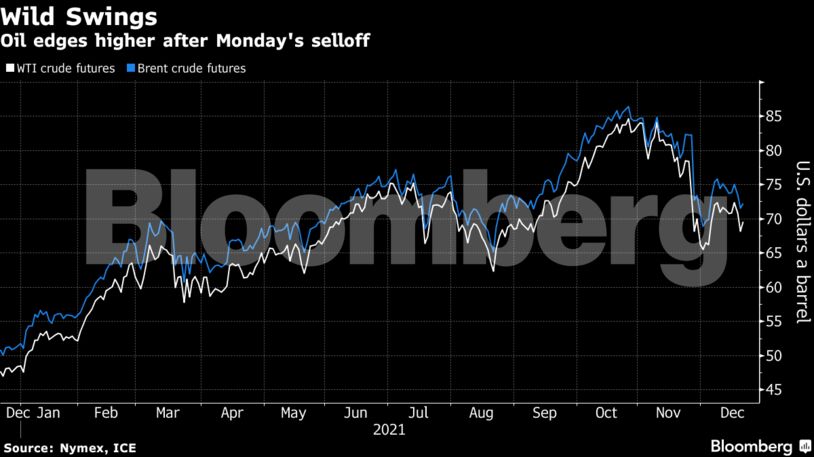

Still, oil has faltered toward the end of the year, in part due to the emergence of the new Covid-19 strain ahead of winter. The oil market structure is flashing bearish signs, indicating near-term over-supply, which may require OPEC+ to act when the group meets next month.

“A relief bounce is unlikely to drive a major turnaround in sentiment with the Brent prompt spread signaling an oversupplied market” said Ole Hansen, head of commodities strategy at Saxo Bank A/S.

| Prices |

|---|

|

See also: Chinese Road Congestion Falls to Lowest in Four Weeks: BNEF

The rout across financial markets on Monday was exacerbated by Senator Joe Manchin’s rejection of President Joe Biden’s roughly $2 trillion package. The president spoke to Manchin on Sunday, a conversation that the White House believes left the door open to revive talks on the spending plan, according to a person familiar with the matter.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS