It’s an unusual step that underscores the difficulty in assessing the supply-demand balance over the short term due to the omicron variant and the U.S.-led release of national crude reserves.

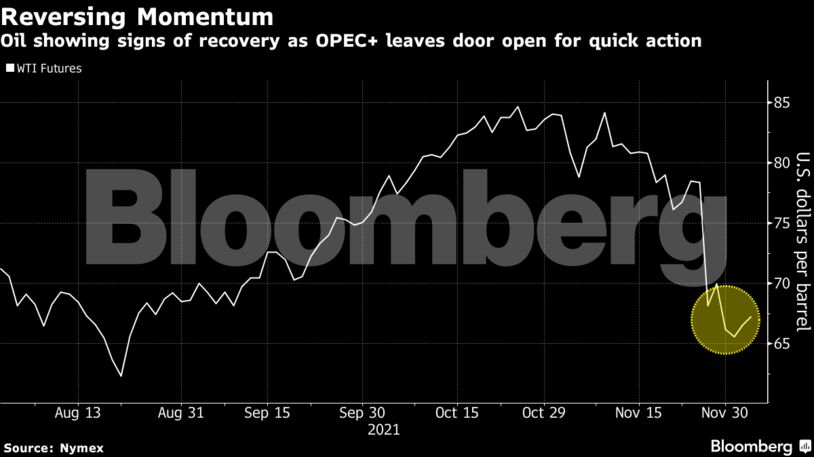

Crude has dropped sharply since late October amid moves by major consuming nations to tap their reserves and the emergence of the new virus variant. A more hawkish Federal Reserve was put in a tough spot Friday as U.S. jobs data missed expectations. Meanwhile, the sharp increase in volatility has oil traders heading for the exit, with open interest across the main oil futures contracts plunging to its lowest level in years.

“The bottom might have been reached on Thursday, unless we get some bad news on the new variant,” said Giovanni Staunovo, a commodity analyst at UBS Group AG.

| Prices |

|---|

|

Prior to the meeting, OPEC+ ministers indicated they were concerned about the impact of omicron on crude demand but were struggling to figure out how serious the new strain would become. By effectively keeping its monthly meeting open, the alliance now has more flexibility to address price swings.

“This may turn out to be the cleverest, even if unintentional, jawboning by OPEC+,” said Vandana Hari, founder of Vanda Insights in Singapore. “The market may take a break from its panicky selloff if it sees that OPEC+ is not ready to factor in the worst-case scenario until it has more data and information on omicron.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Busting Biases, Boosting Innovation – Geoffrey Cann