(Bloomberg)

Oil held near the highest settlement in four weeks as traders weighed falling U.S. crude stockpiles against the threat to demand from the omicron virus variant.

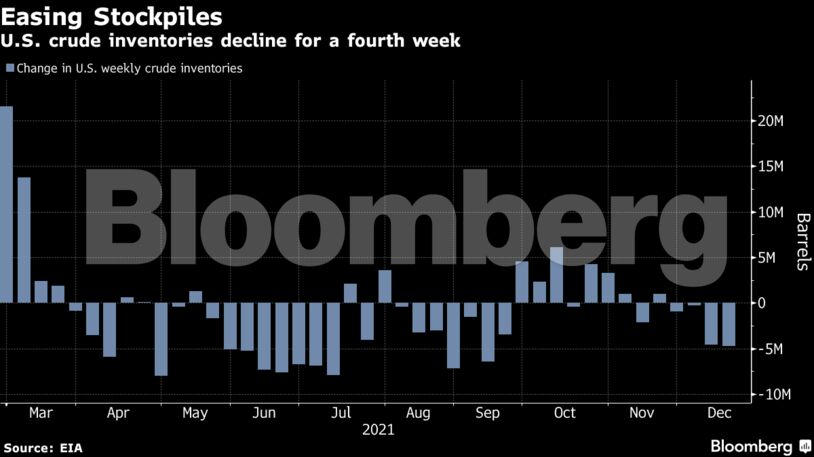

Futures in New York traded below $73 a barrel, though liquidity is dwindling heading into the holiday period. U.S. crude inventories dropped by 4.72 million barrels last week, according to government data, almost twice the median estimate in a Bloomberg survey. That offset some concerns about the impact of the omicron variant on global consumption.

Trading volumes are starting to thin before Christmas, while open interest — the total number of oil contracts held by traders — for crude, gasoline and diesel futures combined is at its lowest in almost six years. Both could leave the market prone to sharp moves amid thin liquidity.

South Korea, meanwhile, will start releasing crude and oil products from its strategic reserves next month, the first major consumer to follow through with a pledge to tap emergency stockpiles as part of a U.S.-led initiative.

Oil is heading for an annual gain following a strong rebound from the pandemic, but there are bearish headwinds mounting for the market including the omicron virus strain. However, an energy crunch in Europe and disruptions to supply in Libya and Nigeria have led to some tightening.

The market is seeing “some sideways trading toward the holidays with liquidity drying up,” said Hans van Cleef, a senior energy economist at ABN Amro Bank NV. “The uncertainty regarding omicron and the impact of the larger number of lockdowns is negative for prices. However the lower inventories faded that effect out.”

| Prices |

|---|

|

U.S. gasoline stockpiles rose by 5.53 million barrels last week, according to the Energy Information Administration. Crude stockpiles at the key storage hub of Cushing expanded by 1.46 million barrels, climbing for a sixth week.

Meanwhile Exxon Mobil Corp. reported a fire at its Baytown oil-processing facility in Texas. The plant is the fourth-largest refinery in the U.S. and has a capacity of about 561,000 barrels a day.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS