“We have done a remarkable job,” he said during the Russian Energy Week conference. “Gas markets, coal markets, other sources of energy need a regulator. This situation is telling us that people need to copy and paste what OPEC has done.”

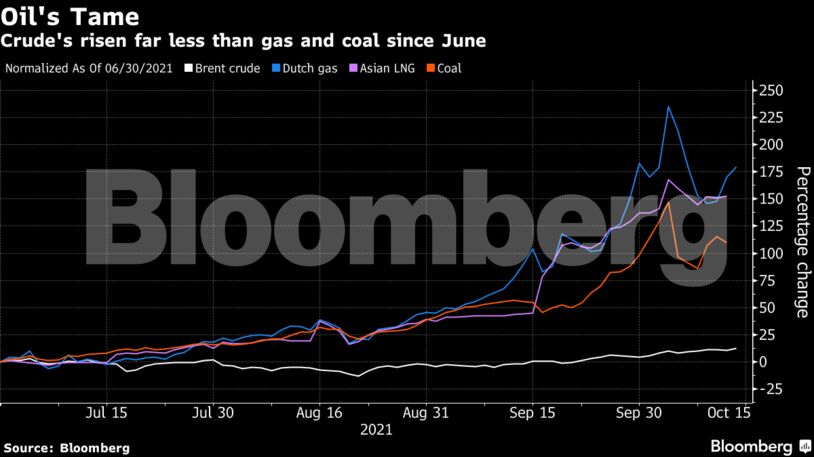

Gas futures in Asia and Europe have soared by more than 150% since the end of June, while coal’s doubled. Brent crude, by contrast, is up 12%.

The Organization of Petroleum Exporting Countries and allies including Russia and have been under pressure from major consumers to accelerate the pace of their supply increases. The calls have become louder since the surge in gas prices caused some power producers to switch to oil.

“Unlike the gas market, the oil market is now more predictable, more understandable for market participants,” Russia’s Deputy Prime Minister Alexander Novak, who handles energy policy, said on the same panel. “Today’s prices and the current balance of supply and demand reflect the current actual situation.”

The United Arab Emirates’ Energy Minister Suhail Al-Mazrouei echoed their comments and said there was no danger of the oil market overheating because of OPEC+’s stance.

“You need to trust us because we have enough experience dealing with different cycles,” he said.

Next Year’s Different

Prince Abdulaziz said he was concerned about the oil market shifting to a supply surplus in 2022 and ending the year with a “huge amount of over stocks.”

“We’ll have a challenging year,” he said. “We keep telling people we should look way beyond the tip of our noses.”

Several traders and Wall Street banks forecast that global oil demand will drop below supply around early 2022. The daily balance will change from a supply deficit of around 1.5 million barrels now to a surplus of almost 2 million by March, according to JPMorgan Chase & Co.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS