Brent crude rose 0.9% to $83.95 a barrel as of 9:21 a.m. in London, bringing the increase for the week to almost 2%.

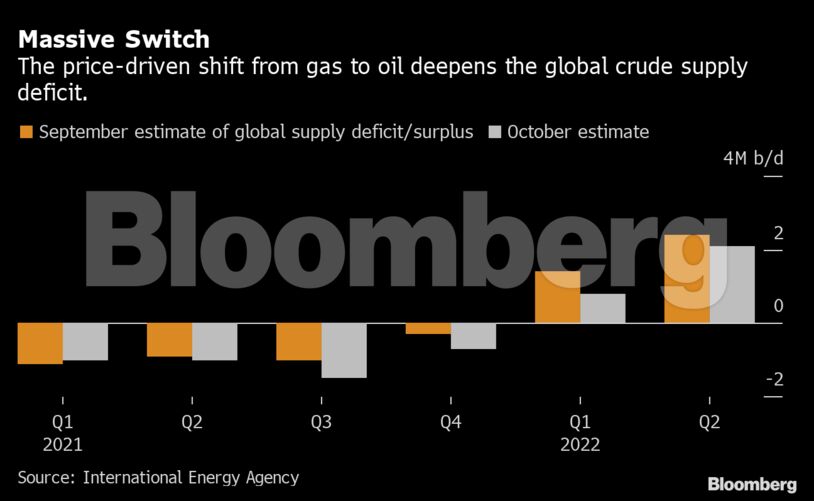

The IEA raised its estimate for demand growth this year by 300,000 barrels a day to 5.5 million barrels a day, and increased it slightly for 2022 to 3.3 million barrels a day. The effect of oil-gas switching will mostly be felt this quarter and next, the agency said.

The gas crisis isn’t entirely a net positive for oil consumption. The increase in the IEA’s demand estimates was tempered by a weaker outlook for GDP resulting mainly from supply-chain issues and rising energy costs.

“The surge in prices has swept through the entire global energy chain,” the IEA said. “Higher energy prices are also adding to inflationary pressures that, along with power outages, could lead to lower industrial activity and a slowdown in the economic recovery.”

The agency noted that the Organization of Petroleum Exporting Countries and its allies stuck to their plan to boost production by 400,000 barrels a day “despite calls from major consuming countries for a more substantial increase.”

OPEC+ showed no signs of deviating from its plan. Speaking at Russian Energy Week in Moscow, Saudi Energy Minister Prince Abdulaziz bin Salman reiterated his commitment to a gradual and phased revival of idle supply. The crisis engulfing other energy markets shows what a good job the group has done in regulating oil, he said.

Global oil production will rise by about 2.7 million barrels a day from September to the end of the year as OPEC+ continues to unwind its cuts and U.S. output recovers from the damage caused by Hurricane Ida, the IEA said. Even with those additions, the market will be in a supply deficit of about 700,000 barrels a day for the rest of this year, before flipping back into surplus in early 2022, the IEA said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS