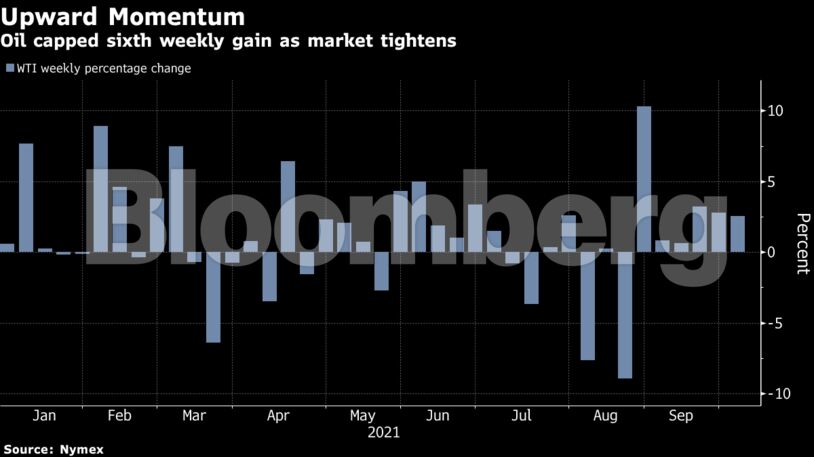

The market has tightened significantly recently following a robust rebound in demand from economies recovering from the pandemic and supply disruption in the Gulf of Mexico due to Hurricane Ida. Surging natural gas prices ahead of winter have also raised the prospect of higher volumes of oil products being consumed in power generation, potentially boosting overall demand.

“I’m not saying they won’t add more than 400,000 barrels a day down the line, but for today we think that’s unlikely,” Energy Aspects’ Sen said in an interview with Bloomberg Television. “Saudi Arabia is very, very keen to reduce volatility, both on the upside and the downside. That’s the key. If suddenly prices spiked, then they’ll be very quick to react.”

| Prices |

|---|

|

OPEC+ production policy will be the main factor influencing oil prices over the coming months, according to Vitol Group. There’s little chance of Iranian barrels returning this year and U.S. shale producers aren’t investing enough to raise output quickly, Mike Muller, the head of Asia for the oil trading house, said on a Sunday webinar hosted by Dubai-based consultancy Gulf Intelligence.

Fuel switching due to high coal and gas prices is likely to push oil demand higher by 500,000 barrels a day this winter, Sri Paravaikkarasu, head of Asia oil at consultant FGE, said in a Bloomberg Television interview. A cold winter could see consumption climb by a further 200,000 to 300,000 barrels a day, she added.

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS