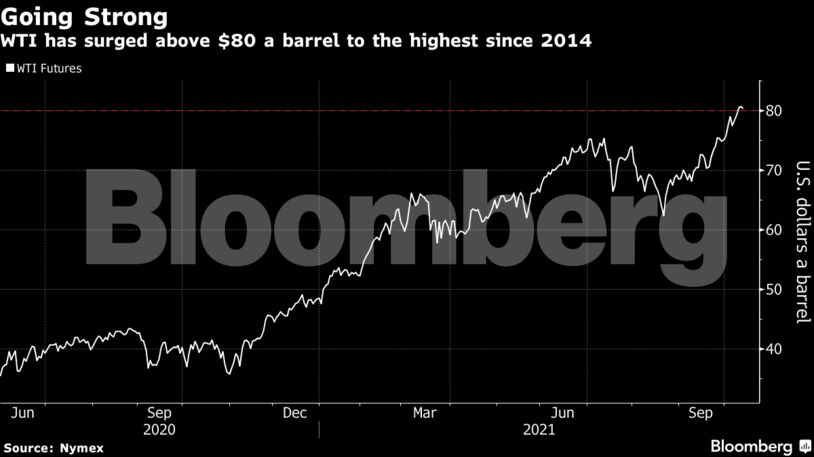

West Texas Intermediate edged lower after posting the highest close since October 2014. OPEC revised down its estimate for oil demand this year in its monthly report. Shortly after, President Putin said Russia is ready to supply as much gas to Europe as it needs. Prices have rallied in recent weeks on the potential for consumers to switch away from gas to oil.

Elsewhere, the IEA said in a flagship report that the world was failing to invest in energy on the scale that’s needed to avoid sharp increases in fossil-fuel prices and at the same time avoid catastrophic climate change.

Crude has surged this year as a rebound in activity from the pandemic has boosted consumption, depleting inventories. In addition, shortages of natural gas and coal have driven rising demand for alternative power generation and heating fuels in Asia and Europe as the Northern Hemisphere winter nears.

“Oil prices took a breather for the first time in four days,” said Keshav Lohiya, founder of Oilytics. “Inflation which is normally bullish commodities can now be seen as a drag on oil demand with Indian and Chinese economies likely to take a hit.”

| Prices: |

|---|

|

In the physical market, Russian Sokol — a diesel-rich grade when refined — has hit the highest premium to the benchmark since January 2020, according to traders and data compiled by Bloomberg. That offers fresh evidence of the scope for oil benefiting from the rally in gas as users seek alternatives.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS