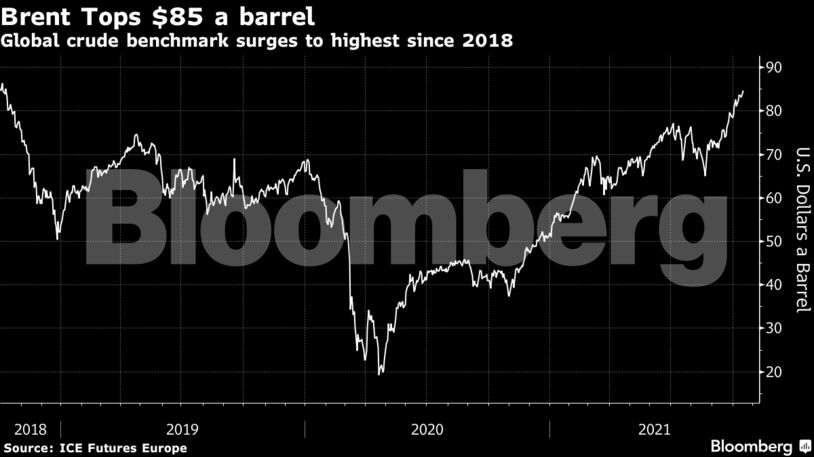

Brent futures briefly passed that level, before paring gains. A shortage of gas and coal is triggering extra demand for oil products from the power market, and some banks expect the switch to boost prices further with winter approaching in the northern hemisphere. It’s starting to deplete stockpiles, with the U.S. crude storage hub of Cushing recording an unusually large drop for the time of year.

China also issued a long-awaited new batch of quotas for its refiners to buy more crude, further pushing up demand.

Brent is set for its sixth straight week of gains. While demand is surging with economies rebounding from the pandemic, supply remains curtailed. Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman reiterated on Thursday the need for OPEC and its allies to take a gradual, phased approach to restoring output.

Prices will likely be “supported with demand rising by switching in the power sector and OPEC+ sticking to a prudent approach in bringing back supply,” said Giovanni Staunovo, commodity analyst at UBS Group AG. Commercial oil inventories are at their lowest since 2015 in OECD countries, and are likely to fall further, he said.

| Prices |

|---|

|

The price surge, including for other energy commodities and metals, is adding to concerns of policymakers about consistently high inflation. Copper on Friday jumped above $10,000 a ton as inventories fell to the lowest since 1974, while zinc hit a 14-year high. Benchmark natural gas in Europe fell but is heading for a weekly gain.

It’s also starting to put pressure on big consumers. The U.S. is talking to OPEC+ members over oil supply and is “expressing in private our concerns,” State Department Spokesman Ned Price said Thursday.

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS