Mar 10, 2021

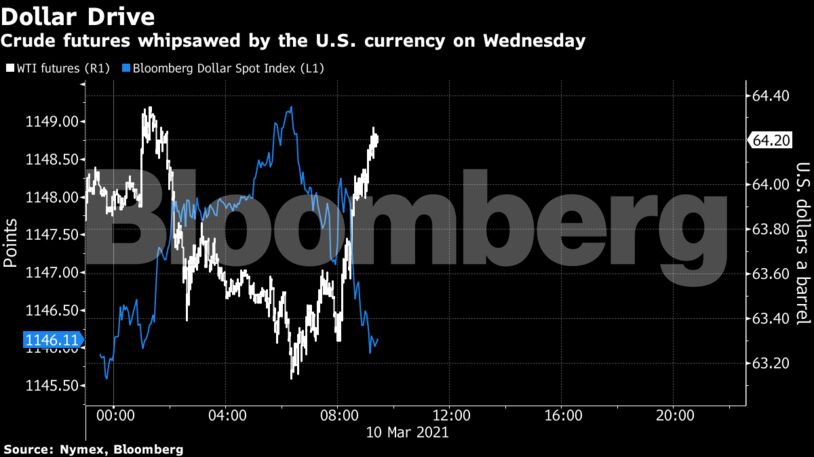

Futures in New York edged lower on Wednesday, after falling more than 3% over the past two sessions. Market volatility has also been creeping higher in recent weeks. The American Petroleum Institute reported crude inventories rose last week, while gasoline stockpiles fell, according to people familiar.

Still, there are signs of weakness in the market. WTI’s nearest timespread briefly erased all of its backwardation — a structure that indicates tightness — on Tuesday. Oil production across American shale patches next year is expected to climb to the highest annual rate since 2019, according to a government report.

Crude is still up more than 30% this year, hitting a multiyear high on Monday as the market tightens. Output cuts from Saudi Arabia and OPEC+, and an improving demand outlook with the rollout of Covid-19 vaccines have both aided the rally. Tensions have also escalated in the Middle East after a key crude export terminal in the kingdom was attacked on Sunday, adding to a recent series of assaults on the major producer.

“Global oil inventories could be back to normal already in May this year,” said Bjarne Schieldrop, chief commodities analyst SEB AB. “OPEC+ is keeping the market much tighter this year than we had expected.”

| Prices |

|---|

|

There are already signs that oil demand is recovering. An Idled plant in the Philippines will restart in the second half as fuel sales rebound in the Asian nation. Congestion in New York is also clawing back, with this month set to mark the fastest increase in toll route traffic since November 2019.

See also: Tanker Rates to Ship U.S. Oil to Europe Rise 80% After Cold

U.S. gasoline inventories dropped by 8.5 million barrels last week, while distillates — a category that includes diesel — fell by 4.8 million barrels, the API said. Crude stockpiles rose by almost 13 million barrels, which would be a third weekly gain if confirmed by government figures on Wednesday.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS