Feb 16, 2021

The combination of frigid temperatures and refinery closures has spurred a scramble for fuels and is likely to lead to higher U.S. prices for all kinds of products from gasoline to propane.

“There are some tailwinds behind oil prices at the moment,” said Fiona Boal, Head of Commodities and Real Assets at S&P Dow Jones Indices LLC. “We will continue to see these spurts of either very cold or very hot weather that can have drastic and immediate impact on supply, but they don’t tend to be very long-lasting.”

The crisis is just the latest in a series of cold snaps in the northern hemisphere that have boosted oil consumption this year.

In Europe, the North Sea oil market, which helps price more than two-thirds of the world’s crude, also saw its biggest spate of bullish activity in years on Monday. Meanwhile, a potential refinery worker strike in Norway was averted after the SAFE union struck a deal with the Norwegian Oil & Gas Association.

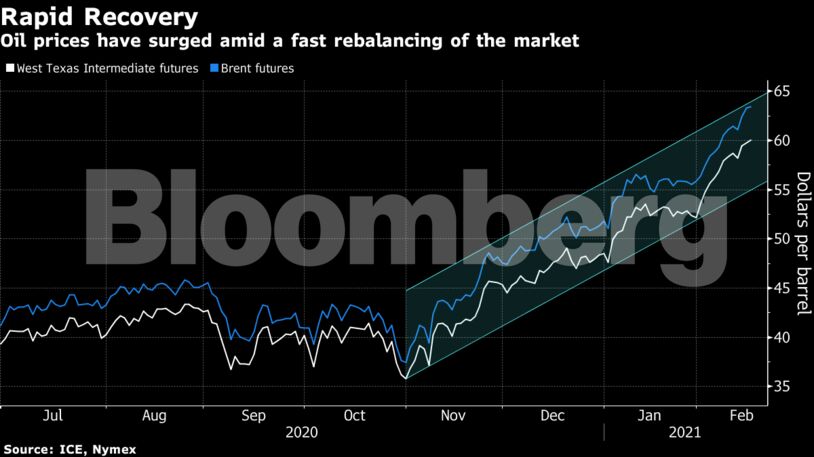

Saudi Arabia’s unilateral output cuts have helped the global crude benchmark rally more than 20% this year as swollen global stockpiles are drawn down even as a stubbornly persistent coronavirus leads to more lockdowns.

| Prices |

|---|

|

The rebalancing and U.S. crisis are rapidly reshaping oil’s futures curve. Brent’s prompt timespread is 60 cents a barrel in backwardation — a bullish market structure where near-dated prices are more expensive than later-dated ones — compared with 29 cents at the beginning of last week.

Still, concerns remain over the sustainability of crude’s rally. Both Brent and WTI’s 14-day Relative Strength Indexes remain well above 70 in a sign that prices could be due for a pullback. In China, the world’s biggest oil importer, travel over the Lunar New Year period is well below normal levels amid a resurgence of Covid-19 in parts of the country.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS