By Anthony Di Paola

OPEC and its allies such as Russia are weighing recent price gains against fresh coronavirus lockdowns that could stifle energy demand as they try to determine whether to increase oil output next month.

The OPEC+ alliance, led by Riyadh and Moscow, agreed in early December to pump an extra 500,000 barrels a day in January, and it’s meeting this week to consider an increase of the same size in February. The talks were meant to conclude on Monday, but will drag on amid an impasse between Russia, which wants to boost output, and others who believe production should remain unchanged next month.

As OPEC+ members begin opening their taps, more will end up exceeding their quotas, said Bob McNally, president of consultant Rapidan Energy Group and a former White House official. For now, Russia and Iraq are “by far” the biggest quota-busters, he said to Bloomberg Television.

Iraq, mired in an economic crisis, has angered the Saudis by pumping above its cap on several occasions since OPEC+ agreed to cuts in April. Baghdad is siding with Riyadh during this week’s meeting, however, in urging the group not to hike supply further in February.

Oil prices rallied after the cartel started its cutbacks, but still fell about 25% during 2020. Brent crude dropped a second day on Tuesday, sliding 0.5% to $50.85 a barrel by 3:09 p.m. in Singapore.

Iraqi Oil Minister Ihsan Abdul Jabbar said in December that his nation would respect its production cap even as it raised exports over the course of the month.

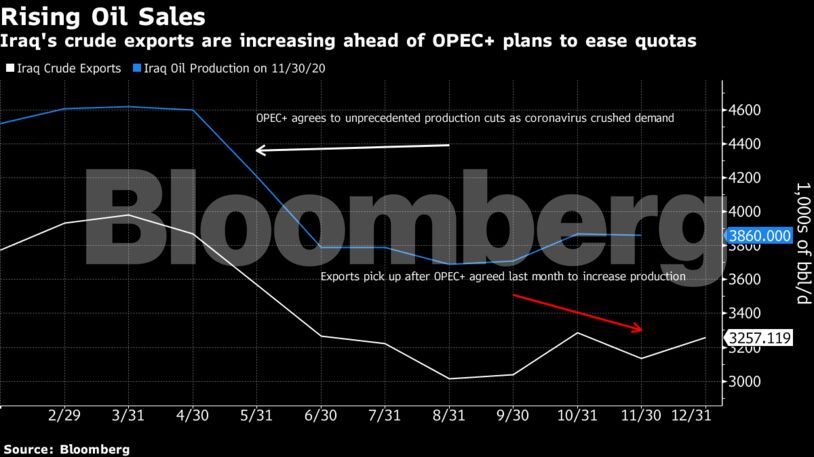

Baghdad’s quota was about 3.8 million barrels a day in December, before accounting for compensation cuts that it promised for the earlier breaches. Iraq pumped 3.86 million barrels daily in November, according to a Bloomberg survey, when exports were 3.13 million barrels a day. A survey showing OPEC’s December production will be published later this week.

IRAQ TANKER TRACKER: December Oil Sales Rise as OPEC Mulls Quota

Although exports aren’t a direct gauge of production, they do shed light on a country’s actual output. Iraq can consume as much as 650,000 barrels a day of crude in its refineries and often uses oil in power plants. To have met its quota last month, Iraq would have had to curb domestic use or sell crude held in storage.

Exports from neighboring Iran also rose in December, reaching the highest level since March, according to tanker-tracking data. Iran is exempt from an OPEC+ production limit, however, due to U.S. sanctions. Oil Minister Bijan Namdar Zanganeh said in mid-December that his country planned to roughly double production in the next year to 4.5 million barrels daily as it anticipates a loosening of sanctions after Joe Biden becomes president.

Russia has breached its output targets as well, according to data from the International Energy Agency. Moscow’s compliance with the OPEC+ deal has averaged 95%, meaning it has pumped about 100,000 barrels a day above its limit.

“For some reason, Russia and Iraq have been given a little bit of leeway to lag,” McNally said. He sees “no sign really of them coming into full compliance soon, much less making up for their owed barrels.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS