By Salma El Wardany, Grant Smith and Javier Blas

While Russia, the cartel’s de-facto leader alongside Saudi Arabia, publicly backed an additional boost in late December, the outlook has shifted since then. Covid-19 vaccinations are accelerating, but a faster-spreading variant of the virus threatens to plunge some economies back into full lockdown before immunity becomes widespread.

“There’s a need to be wary of the repercussions of the second wave of the pandemic,” state-run Kuwait News Agency reported on Monday, citing a statement from Oil Minister Mohammed Alfares. “Kuwait supports decisions that will maintain oil-market stability.”

The Organization of Petroleum Exporting Countries and its allies will hold a video conference at 2:30 p.m. Vienna time to decide whether to add more barrels to the market. They are currently idling 7.2 million barrels a day, or about 7% of world supplies, and plan to return a further 1.5 million barrels a day in careful installments.

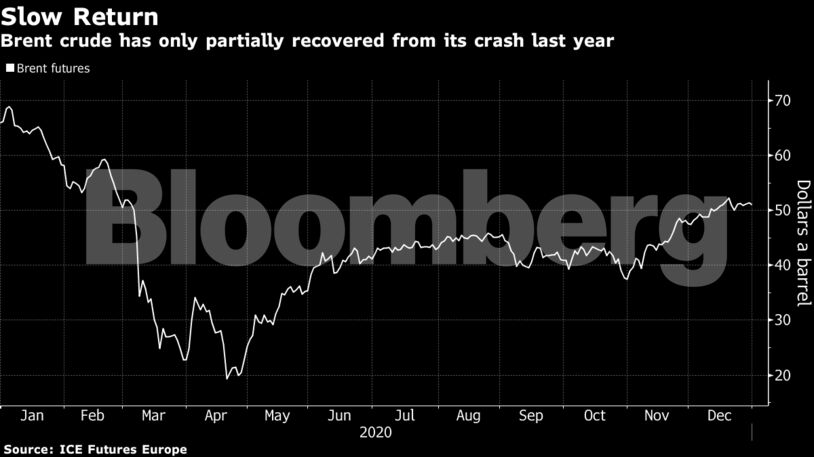

The group is already taking a cautious approach, agreeing in December to meet every month — rather than just a few times a year — in order to fine-tune production levels more precisely and avoid capsizing the price recovery they spent most of 2020 working to achieve.

The cartel’s top official warned of risks to the oil market from the resurgent pandemic. “The outlook for the first half of 2021 is very mixed,” OPEC Secretary-General Mohammad Barkindo said at Sunday’s preparatory meeting. “There are still many downside risks to juggle.”

Brent crude rose for a fourth day on Monday, gaining 0.9% to $52.28 a barrel at 9:53 a.m. in London. Prices were supported by stronger demand in Asia due to freezing weather and a weaker dollar, which boosts the appeal of commodities priced in the currency.

Click here to follow Monday’s OPEC+ TopLive blog

The case for another small OPEC+ output increase in February is underpinned by a recovery in the oil price, and the emergence of Covid vaccines.

The vaccines have created a “healthier” outlook for oil consumption, which will soon “shift from reverse to forward gear,” Barkindo said at the Joint Technical Committee meeting on Sunday. The panel assesses implementation on behalf of the 23-nation alliance.

Russian Deputy Prime Minister Alexander Novak signaled last month that he was ready to proceed, saying that prices are in an optimal range of $45 to $55 a barrel. If OPEC+ refrains from bolstering exports, its competitors will simply fill the gap, he said.

Oil prices have stabilized above $50 barrel in London despite OPEC’s pledge of extra supply, bolstered by vaccine developments and robust fuel use in Asia. Supply and demand should remain broadly balanced in the first half of the year, according to the Paris-based International Energy Agency.

Gulf Allies

“The market has underlying support and as such should shrug off a modest increase in OPEC+ supply,” said Doug King, chief investment officer of the Merchant Commodity Fund, which manages $170 million.

It’s not just Russia that might favor opening the taps. Last month, OPEC+ talks ran into a five-day stalemate as Saudi Arabia and the United Arab Emirates — for years stalwart allies in both political and energy spheres — disagreed over how quickly to revive the idled barrels.

While the kingdom wanted to delay any increases for three months, its neighbor — eager to monetize investments in capacity and promote a new regional oil benchmark — pushed for a speedier timetable.

That might also come as a relief to OPEC+ members like Iraq. Baghdad is engulfed in a mounting economic crisis that is only exacerbated by limits on oil sales, and is struggling to get through a backlog of overdue output cuts from 2020.

Barkindo’s Caution

Yet there are also reasons to think the group will take a more cautious approach.

“We think the producer group will opt to forgo any further production increases for February with Covid-19 cases continuing to climb and the slower than expected vaccine roll-out,” said Helima Croft, chief commodities strategist at RBC Capital Markets LLC.

Restrictions on movement are still in place in a number of countries amid a new strain of the virus, Barkindo said. It’s too soon to know how key sectors of the economy will be affected, and for the tourism and leisure industries the return to pre-crisis levels could take a couple of years.

Oil inventories in developed nations remain 163 million barrels above their five-year average, Barkindo added. Despite the market’s rebound, crude prices are far below the levels most OPEC members need to cover government spending.

While the IEA anticipates no fresh surplus, it warned that the existing inventory overhang will linger to the end of the year if OPEC+ opens the taps.

The decision is “a very close call,” Bob McNally, president of consultant Rapidan Energy Group and a former White House official, said to Bloomberg Television on Monday. “I wouldn’t like to bet a lot of money on it.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein