By Salma El Wardany, Grant Smith and Javier Blas

Ministers needed more time to resolve differences over how much extra oil the market can take as the resurgent pandemic brings tighter lockdowns, but after informal discussions on Tuesday a compromise was still elusive, delegates said.

The split between Saudi Arabia and Russia, the two de-facto leaders of OPEC+, reflected contrasting priorities. Riyadh has shown it’s worried about undermining the oil-market recovery, while Moscow said it doesn’t want to create space for a rebound in rival production.

Their strategic differences resonate far beyond the 500,000 barrel-a-day supply boost the market had been expecting for February. It also calls into question similar increases traders had penciled in for March and April.

“Russia is currently focusing on market share while a number of other countries value prices,” Iran’s Oil Minister Bijan Namdar Zanganeh told reporters on Monday, according to the ministry’s news service Shana.

While Russia appeared to be outnumbered on this occasion, OPEC+ typically requires a consensus among all members before concluding talks. Failure to reach a compromise is rare but can have damaging consequences, notably last year’s monthlong price war.

Before gathering again at 3:30 p.m. Vienna time, Riyadh and Moscow held informal talks, and delegates were set to consult with their home governments.

Urging Caution

In Monday’s aborted video conference, the initial positions of the two OPEC+ kingpins were diametrically opposed. Saudi Energy Minister Prince Abdulaziz bin Salman proposed rolling back the 500,000 barrel-a-day production increase the group made this month, delegates said. Russian Deputy Prime Minister Alexander Novak wanted to maintain that supply hike and add the same again in February.

In his opening remarks, Prince Abdulaziz highlighted the risks to the oil market from a more infectious strain of the coronavirus, which has heightened the economic risks even as the roll-out of vaccines has buoyed prices.

“At the risk of being seen as a killjoy in the proceedings, I want to urge caution,” he said. “The new variant of the virus is a worrying and unpredictable development.”

The prince, who has consistently sought to keep a tight rein on supply, also indicated he would accept rolling over current output levels into February, delegates said. Algeria, Nigeria, Oman, Iraq, Kuwait and the United Arab Emirates were also in favor of holding supply steady, they said, asking not to be named because the meeting was private. Kazakhstan supported Novak’s position.

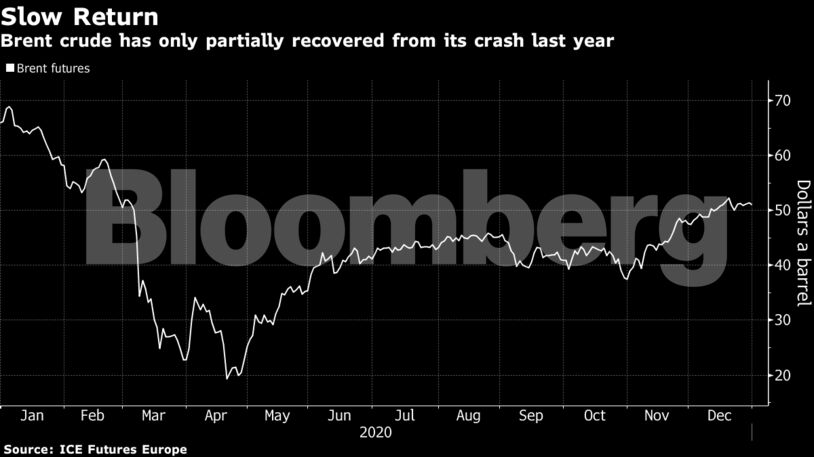

Crude could stabilize above $50 a barrel in the first half of the year if OPEC+ makes the right decision, Algeria’s Oil Minister Abdelmajid Attar told state news agency APS on Tuesday. Brent crude, the international benchmark, rose 1.3% to $51.77 a barrel at 1:33 p.m. in London.

The Organization of Petroleum Exporting Countries and its allies are currently idling 7.2 million barrels a day, or about 7% of world supplies, and had planned to return a further 1.5 million barrels a day in installments over the coming months.

The group is already taking a cautious approach, agreeing in December to meet every month — rather than just a few times a year — in order to fine-tune production levels more precisely and avoid capsizing the price recovery they spent most of 2020 working to achieve.

Other prominent voices from the alliance have echoed Prince Abdulaziz’s caution. “There’s a need to be wary of the repercussions of the second wave of the pandemic,” state-run Kuwait News Agency reported on Monday, citing a statement from Oil Minister Mohammed Alfares. OPEC Secretary-General Mohammad Barkindo said at Sunday’s preparatory meeting that “there are still many downside risks to juggle.”

Tighter Lockdowns

The case for another small OPEC+ output increase in February is underpinned by a recovery in the oil prices, which have gained more than a third since the emergence of the first Covid vaccines last year — though they still fell around 25% during the whole of 2020.

Russia’s Novak said last month that OPEC+ should proceed with its supply increase because prices are in an optimal range of $45 to $55 a barrel. If OPEC+ refrains from bolstering exports, its competitors will simply fill the gap, he said.

Yet there are also reasons to think the group will take a more cautious approach.

Restrictions on movement are still in place in a number of countries amid a new strain of the virus, Barkindo said. It’s too soon to know how key sectors of the economy will be affected, and for the tourism and leisure industries the return to pre-crisis levels could take a couple of years.

“Demand is strong in Asia, but there’s plenty of oil in the market to cater for that,” Ole Hansen, head of commodities strategy at Saxo Bank A/S, said on Bloomberg TV. OPEC+ should “stay the course and wait until March” before boosting output, he said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS