By Alex Longley and Elizabeth Low

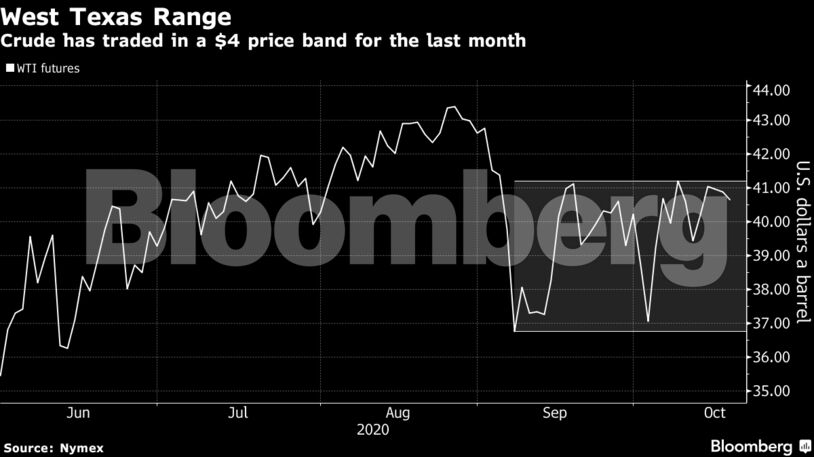

With uncertainty dominating the market, prices have struggled to break far away from $40. While there was renewed optimism about a stimulus deal in the U.S. on Monday, the International Energy Agency said the outlook for the market remains fragile due to the pandemic. That leaves OPEC+ treading a fine line as it decides whether to add more supply.

“The fact that Russia’s President Putin and Saudi Prince Bin Salman talked to one another on the phone twice last week suggests that the plans of OPEC and its allies are soon likely to be closely reviewed,” said Eugen Weinberg, head of commodities research at Commerzbank AG. “The fundamental situation on the oil market is certainly cause for concern, with ongoing demand weakness on the one hand and rising production on the other.”

| Prices |

|---|

|

Though coronavirus restrictions continue to grow, in the short-term there are signs that markets are tightening. Brent’s nearest futures contract ended last week at its smallest discount to the next month since the end of July, a market structure that indicates easing concerns about oversupply. It comes as a unit of China’s Rongsheng Petrochemical purchases large amounts of crude for a refinery expansion.

If market conditions don’t change by Dec.1, OPEC+ is likely to decide to bring back less supply than the currently planned 1.9 million barrels a day in January, Citigroup Inc. analysts including Ed Morse wrote in a report. On Friday, JPMorgan Chase & Co. analysts, including Natasha Kaneva said the group may choose to defer its output taper by a quarter.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS