By Andres Guerra Luz

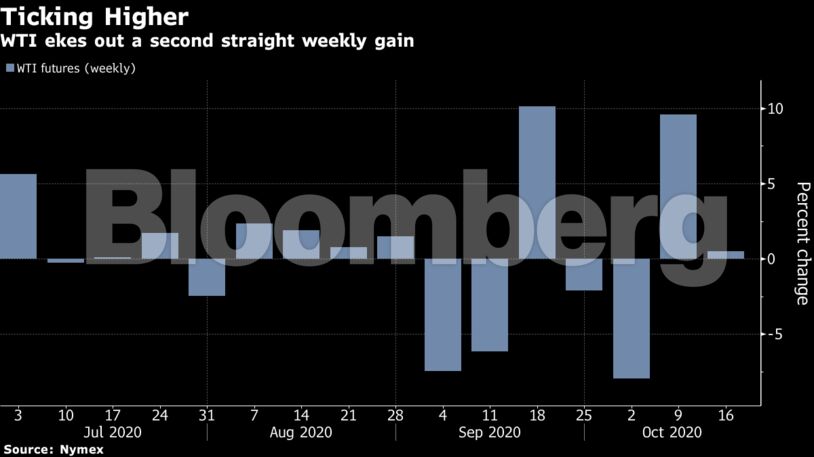

Crude futures in New York have clung close to the $40-a-barrel mark since September amid uncertainty around a demand recovery as the virus rages. Meanwhile, OPEC producers and allies see a risk of an oil surplus next year if Libya’s production rises and demand remains depressed.

At the same time, the market’s structure continues to strengthen, with the spread between Brent’s nearest contracts at its narrowest since late July. For West Texas Intermediate futures, the prompt spread rallied to its tightest contango in a month.

| Prices |

|---|

|

Prices pared earlier losses on Friday after American retail sales and consumer sentiment indicators topped estimates.

“We’re having a much stronger consumer than we anticipated, despite a good part of the country struggling to find work,” said Edward Moya, a senior market analyst at Oanda Corp. “Everyone is going to be still consuming a wide variety of goods going into these coming months, and that’s going to be positive for crude.”

The Organization of Petroleum Exporting Countries and its allies are facing pressure to postpone their plans for tapering output cuts. Given the uncertainty over the oil demand outlook, the right course of action is to wait for now, JPMorgan analysts including Natasha Kaneva wrote in a report. The move to add another 2 million barrels of day onto the market in January could be postponed by a quarter, the report said.

OPEC+ is also contending with the unexpected return of Libyan oil output, which hit 500,000 barrels a day this week. The group forecasts that global oil supplies could increase by 200,000 barrels a day next year if Libya manages to revive supply and the pandemic hits demand harder than expected, according to a document seen by Bloomberg.

| Other oil market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS