By Alex Longley and Laura Hurst

Futures rose 0.6% after tumbling below $39 a barrel on Monday. The greenback fell 0.2%, boosting the appeal of commodities priced in the American currency. At the same time, Zeta became the latest storm to threaten U.S. Gulf output.

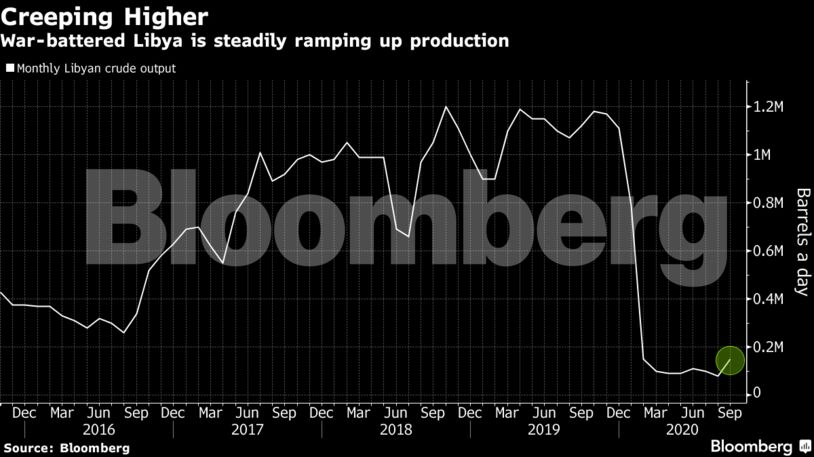

Prices fell sharply at the start of the week as Libya moved closer to boosting output back to 1 million barrels a day. There’s also a lack of agreement on stimulus in the U.S., clouding the broader market outlook. While Asia remains a bright spot for global oil demand, a renewed surge in virus cases across the U.S. and Europe is raising concerns the fragile recovery in consumption will be derailed.

“It’s very difficult to predict what is going to happen with oil and gas right now,” Murray Auchincloss, chief financial officer of BP Plc, said in an interview. “We’ve seen continuous reduction in inventory levels since June, and when those move toward the five-year average I suspect there will be an uptick in price.”

| Prices |

|---|

|

Though headline prices were higher on Tuesday, the market’s underlying structure has softened. Brent’s nearest timespread has weakened by 9 cents over the last two sessions, indicating growing concerns about oversupply as Libyan oil returns.

It’s a similar picture in the U.S., with WTI’s equivalent measure closing on Monday at its weakest since early September. Crude volatility has also jumped in recent days, highlighting trader angst.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS