By Peter Millard, Laura Hurst and David Wethe

Companies can’t just abandon aging offshore wells. In most cases, regulators who approved them required pricey guarantees to make sure they’re properly sealed, and there are environmental issues involved in their upkeep. That can mean the use of divers or robot submarines to plug wells and pipelines on the ocean floor, an expensive proposition, as well as cutting apart and moving steel platforms that can weigh as much as 17,000 tons.

“Abandonment costs will haunt the industry in the years to come, especially if governments get tougher with parent company guarantees,” said Marcelo de Assis, the head of Latin American upstream research at Wood Mackenzie Ltd. “The crisis fast forwarded the situation.”

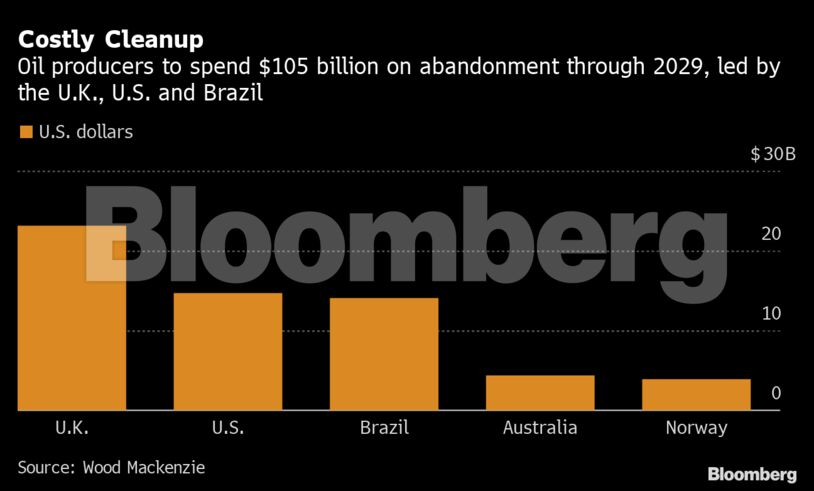

The spectacular decline in North Sea production since it peaked in the 1990s has left so much equipment unused that, by 2025, oil companies will spend more on removing redundant equipment than developing new fields, according to Wood Mackenzie.

Deepwater production was a new frontier for the oil industry in the 1980s and 1990s, and many of these projects are now reaching the end of their lives.

But the push to close offshore wells comes as the oil industry has suffered some major blows. They include a price war between oil giants Saudi Arabia and Russia that flooded the world with oil, a pandemic that destroyed demand and skepticism from investors who want less money spent on exploration and more returned to them.

At the same time, the U.S. shale boom has drastically lowered the cost of opening and operating a well on land, as well as closing one, compared with the price tag tied to wells offshore.

Despite a recent uptick in oil prices, they remain too low and volatile to lure buyers to the aging and small-producing fields Brazil’s Petroleo Brasileiro SA. and other deep-water operators are walking away from. The small- to mid-sized producers with low enough costs to turn a profit from exhausted oil fields are protecting their balance sheets, and banks are reluctant to provide funding.

In the U.S. Gulf of Mexico, which generates about 15% of the nation’s output, explorers are expected to spend about $1 billion a year over the next half decade to decommission hundreds of wells, according to Wood Mackenzie.

While the collapse in oil prices is having an effect on more offshore wells permanently shut, there’s also a push in the Gulf to extend the lives of some aging infrastructure. The key: Drilling new wells near existing platforms that can be fed by undersea pipelines as a way to cut costs.

“Companies are doing everything they can to avoid abandoning facilities because that’s very expensive,” Justin Rostant, principal analyst at Wood Mackenzie, said in a phone interview. “They’re just bringing in third-party production wherever they can to extend the life of these facilities.”

It costs an average of $10 million per well in deepwater and about $500,000 a well in shallow waters to plug and abandon a well in the Gulf of Mexico, Rostant said. Most wells shut down in the U.S. Gulf are coming from shallow waters, where the wells are the oldest and have lost their ability to make money.

U.K. Payout

Meanwhile, the U.K. will be the leader in North Sea decommissioning, followed by Norway and Denmark. The U.K. is forecast to pay out more than 20 billion pounds ($26 billion) to close its platforms in the region by 2030.

Removing offshore platforms can be controversial. Royal Dutch Shell Plc has sought permission to leave the giant concrete “legs” of its iconic Brent field in the North Sea because it says removing them would pose a greater environmental risk. However, Germany and the Netherlands, as well as environmental group Greenpeace, have raised concerns over leaving the structures in the sea.

Brazil’s Goal

The goal in Brazil is to restore the environment as close to its original state as possible, Raphael Neves Moura, a superintendent at ANP, Brazil’s national petroleum agency, said during a web conference held by the Brazilian Petroleum Institute, a lobby group.

ANP introduced regulation in April to handle the influx of deserted equipment due to fallout from the pandemic. The agency will seek to find buyers for discarded fields before moving to abandonment, Moura said.

In a statement, Petrobras said it continues to seek buyers to take on assets it’s written off. Petrobras is planning to auction three Campos Basin platforms that date back to the 1980s for scrap metal in July. These platforms have been off line since 2015 or so, so weren’t part of the 62 shut since the pandemic.

In the first quarter, Petrobras wrote off 62 shallow water platforms, or about 75% of its fleet, as part of a 65 billion real ($12.5 billion) impairment. The wells to be closed only produced a combined 23,000 barrels a day, less than half of Petrobras’s top wells in the so-called pre-salt region.

‘Stress Tests’

In Brazil, the Campos basin has been eclipsed by larger discoveries with higher-quality oil even deeper in the Atlantic, where Rio de Janeiro-based Petrobras is focusing its investments. As a result production has plummeted at these fields, and Petrobras is carrying out “stress tests” at its remaining projects to weed out others that can’t survive.

Rystad expects low service costs to encourage operators worldwide to clear out old equipment now that low oil prices have undermined incentives to extend them.

No matter how the millions of tons of steel and pipes are removed, governments are likely to step in to make sure tax payers aren’t the ones paying, said Wood Mackenzie’s Assis.

“There is a push from regulators. There will be more pressure for financial guarantees,” he said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein