By Javier Blas, Grant Smith and Khalid Al-Ansary

That’s eased pressure on the budgets of oil-rich nations and revived the fortunes of energy companies from Exxon Mobil Corp. to shale drillers such as Parsley Energy Inc.

Trump himself hailed the recovery on Friday and thanked the cartel’s leaders for making it possible.

“Just a month ago. We had a disaster with respect to energy. It was down to zero, it was worthless,” Trump said at the White House. “We saved that industry in a short period of time. And you know who helped us? Saudi Arabia and Russia.”

Bumpy Road

The unlikely celebration in Washington came at the end of a long road that could still have some unwelcome twists and turns.

There’s no guarantee that Trump, who for most of his presidency has been openly hostile to the Organization of Petroleum Exporting Countries, won’t return to accusations of market manipulation and price gouging when it suits him.

The partnership at the heart of OPEC+ — between Saudi Arabia and Russia — was only recently patched up after a vicious price war. This week, the unity of the 23-nation coalition has been strained by some nations cheating on their production cuts.

There’s also a risk that future curbs could be undermined by a return of Libyan oil. The civil war there halted more than 1 million barrels a day of production, helping OPEC+ rebalance the market, but a cease fire now opens the door for a gradual recovery of supply. As a first step, a key valve on a pipeline from the country’s biggest oil deposit reopened Friday, though the field remains shut.

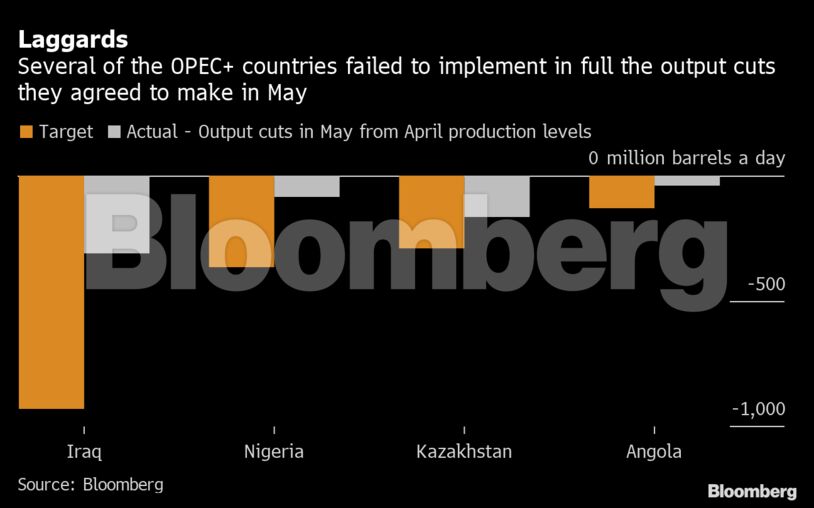

Saturday’s OPEC+ meeting only came together after Moscow and Riyadh pushed Angola, Nigeria, Kazakhstan and Iraq to stop shirking their share of cuts and to compensate for past failings. By Friday, delegates said there was a deal in place to resolve these shortcomings, but details were lacking and observers were skeptical.

In a tweet just hours before the OPEC gathering, Nigeria said it approved of “the concept of compensation by countries who are unable to attain full conformity in May and June,” meaning they must make up their shortfall in July, August and September.

“Everyone saves face with this agreement,” said Jan Stuart, global energy economist at Cornerstone Macro LLC. “But it begs the question: What is the enforcement mechanism? I’m very curious to see how the organization is going to elicit greater compliance from the cheaters.”

OPEC will meet by video conference on Saturday at 1 p.m. London time, followed by a conference with their OPEC+ allies two hours later.

The agreement, once ratified, will prolong the 9.7 million barrels a day of production curbs for another month until the end of July. Ministers may review later this month whether a further extension into August is warranted, a delegate said.

Conditions are now right to achieve the success that Saudi Arabia has hoped for, the state-run Saudi Press Agency reported on Friday, citing the kingdom’s Energy Minister Prince Abdulaziz bin Salman.

Still, OPEC+ is used to dramatic glitches endangering deals at the last minute, so delegates said nothing would be agreed until formal communications take place after Saturday’s meeting.

Iraq’s Pain

The Oil Ministry in Baghdad said in a statement on Friday that it will comply in full with pledged OPEC+ cuts despite the country’s difficult financial circumstances. But accepting stricter terms risks a backlash from Iraqi parliamentarians and rival political parties for acceding to foreign pressure.

Read: Oil’s Fragile Peace Is Threatened by Iraq’s Desperate Reality

Cutting production is always painful for oil-dependent states. Iraq in particular needs every penny because it’s still rebuilding its economy following decades of war, sanctions and Islamist insurgency.

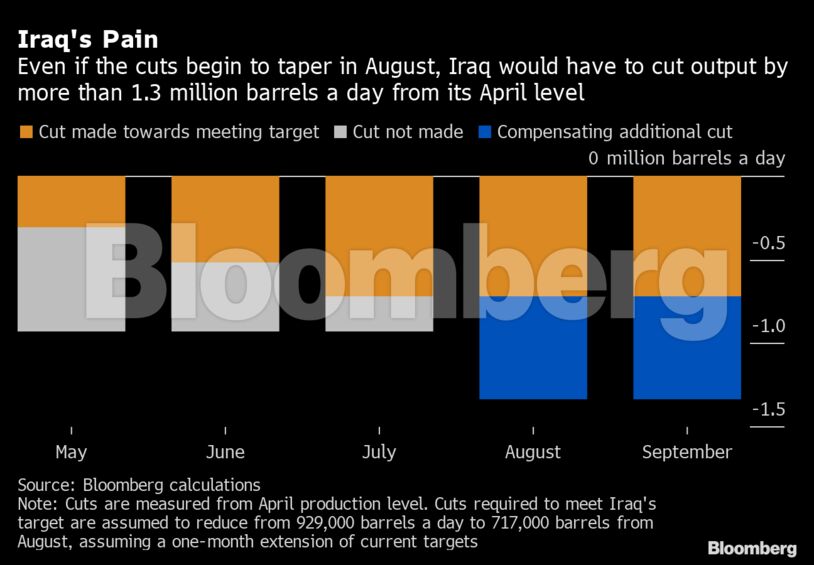

Iraq made less than half of its assigned cutbacks last month, so compensating fully would require it to slash production by a further 24% to about 3.28 million barrels a day, according to Bloomberg calculations. That would be a tall order.

Mexico, whose resistance to curbing output delayed the April deal, won’t cause problems this time, a delegate said. Under the terms of that accord, the Latin American country wasn’t expected to make production cuts beyond June.

Failure to finalize the agreement could bring a flood of oil back onto the market, undermining a tentative recovery as countries start emerging from coronavirus lockdowns. Instead, OPEC+ hopes a successful deal will force the market to start drawing down the billion barrels of stockpiles that built up during the crisis, further bolstering the price recovery.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS