By Elizabeth Low and Alex Longley

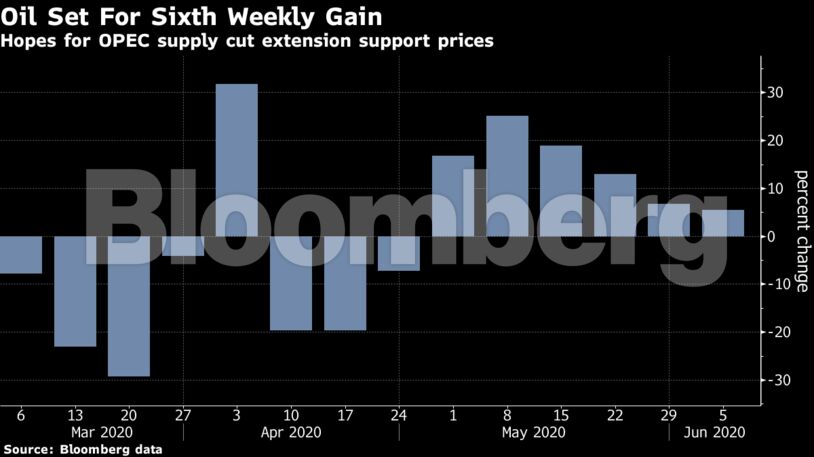

While oil has recovered rapidly from its plunge below zero in mid-April, the pace of the rebound has slowed in the past couple of weeks. Demand is quickly returning in China, but questions remain for many other nations, especially for consumption of diesel, the biggest-selling oil product globally.

A continuation of crude’s price rally could also encourage more American shale producers to bring wells back and lead to a fraying of the consensus within OPEC+, leaving the alliance with a delicate balancing task.

See also: Too Early for Shale Obituary as U.S. Oil Wells Return, IEA Says

“OPEC+ will take one month at a time here,” said Bjarne Schieldrop, chief commodities analyst at SEB AB, which “makes sense since demand outlook visibility is so low.”

| Prices: |

|---|

|

Riyadh and Moscow, on opposite sides of a vicious price war until a deal in April, are now united against countries who have consistently failed to shoulder their share of the burden. Russia, a habitual laggard, has complied punctiliously with the most recent cuts and wants to make sure others are too.

Saudi Aramco has also delayed the release of its July crude pricing until Sunday at the earliest, according to people with knowledge of the situation, as it waits for clarity on the extension of production cuts.

“The world’s oil exporters, including members of the OPEC+ alliance, do not want prices below $30 a barrel, but there’s no consensus on how much higher prices should be,” said Victor Shum, vice president of energy consulting at IHS Markit. If Dated Brent prices move into the $40 to $50 a barrel range there would likely be policy divergence between the Saudis and Russia, he said.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS