By Rachel Adams-Heard

Even before crude prices fell off a cliff, the creation of new funds to invest in oil and gas had dwindled. Now, with demand down and output up around the world, hundreds of private equity-backed producers are faced with the same grim math as the publicly traded independent companies that used to buy them but now rarely do — drilling new wells doesn’t make money at $20 oil.

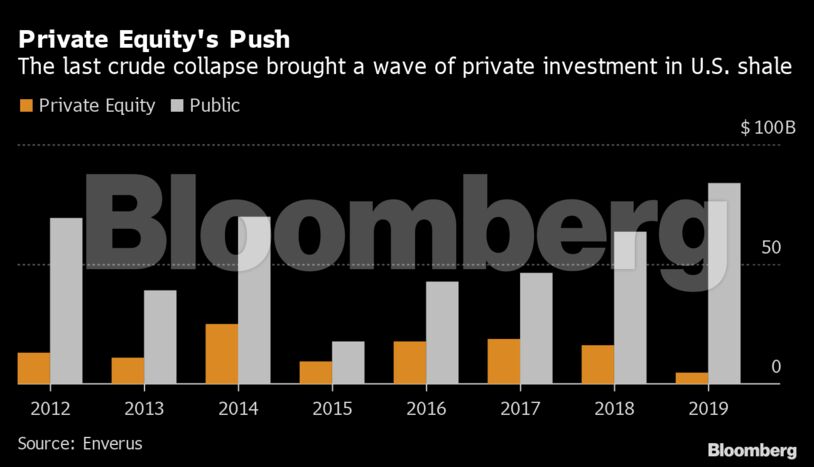

The last time crude dipped into that price range, the private equity funds came to shale country with checkbooks out, dispatching industry veterans to lease acreage and “prove it up” with the aim of selling it off to bigger players.

That business model stopped working at least a year ago. With dealmaking all but gone, shale companies backed by private equity had no payday at the end of their typical three- to five-year cycle. They were forced to start drilling — many of them unprofitably.

“The industry was just vaporizing capital over the last five years,” said Adam Waterous, who runs Waterous Energy Fund in Calgary. Before the current plunge in crude prices, “the U.S. unconventional business was not working, and specifically, the returns that were being earned were atrociously poor.”

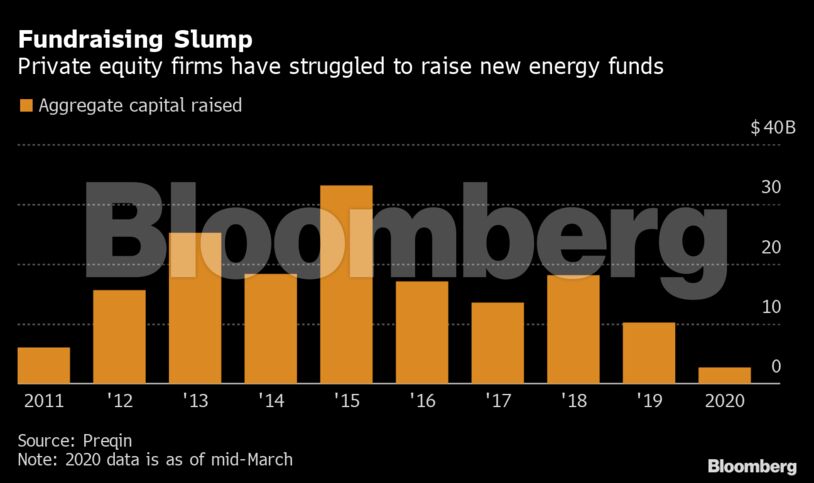

Oil- and gas-focused funds have been among the lowest-yielding asset classes for private capital over 10 years, according to data provider Preqin, with a median internal rate of return about five percentage points lower than those of comparable buyout firms.

Fundraising has stumbled. Private equity firms raised 12 funds last year dedicated to natural resources, Preqin said. That’s down from 32 in 2018 and 20 in 2017. So far this year, just two funds have been created. At this point last year, there were three.

“From our data we can certainly suggest that fundraising is likely to remain challenging,” said Preqin’s Justin Beardon.

The coronavirus has caused a historic collapse of demand at the same time Saudi Arabia and Russia triggered a worldwide glut. Dan Pickering, chief executive officer of Pickering Energy, predicts 25% to 40% of U.S. producers will seek bankruptcy protection. Paul Sankey of Mizuho Securities puts that number closer to 70%.

Even before the mess, publicly traded shale drillers were among the worst performers in the S&P 500. Closely held producers were also showing signs of distress. EP Energy, backed by private equity giants Apollo Global Management Inc. and Elliott Management Corp., filed for bankruptcy protection in October, listing nearly $5 billion of liabilities in what is the largest oil-and-gas producer failure since the middle of the last downturn. Just three months later, EnCap Investments’s Southland Royalty Co. followed suit.

Private equity first flocked to U.S. shale fields in the early days of the last decade as a new technology promised to unlock hydrocarbons in shale rock. Interest rates were low and access to capital was easy.

Even with the oil-price plunge in the last decade, private equity wasn’t deterred. The idea was simple. “Even if oil prices go the wrong way, you’re still going to be creating value” by mastering the technology behind the shale boom, said Dane Gregoris, a director at RS Energy Group. “That thesis is no longer as clear.”

Drilling new wells is unprofitable for virtually every one of the approximately 500 private equity-backed oil and gas explorers in the U.S. today, big or small, according to Waterous.

“The technology really is incredible — it was a revolution — but what happened was it got way overdone,” Waterous said. “In the sober light of day, maybe about 15% or 20% was economic. Three-quarters-plus was completely uneconomic.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS