By Zaid Sabah, Grant Smith and Javier Blas

The delay came hours after Saudi Arabia made a pointed diplomatic attack on Russian President Vladimir Putin, opening a fresh rift between the world’s two largest oil exporters and jeopardizing a deal to cut production.

In a statement early on Saturday, the Saudi Foreign Minister Prince Faisal bin Farhan said comments by Putin laying blame on Riyadh for the end of the OPEC+ pact between the two countries in March were “fully devoid of truth.”

The direct criticism of Putin, echoed in a statement by Energy Minister Prince Abdulaziz bin Salman, threatens a new agreement to stabilize an oil market that’s been thrown into chaos by the global fight against coronavirus. President Donald Trump had devoted hours of telephone diplomacy last week to brokering a truce in the month-long price war between Moscow and Riyadh.

“We always remained skeptical about this wider deal as U.S. producers cannot be mandated to cut,” said Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd. “If so, Russia doesn’t come to the table. And if everyone doesn’t cut, Saudi Arabia’s long held stance is that they will not cut either.”

The prospect of a new deal spurred a 50% recovery in benchmark oil prices last week as traders saw some relief from the catastrophic oversupply caused by a lockdown of the world’s largest economies, in a bit to halt the coronavirus pandemic. With billions of people forced to stay at home, demand for gasoline, diesel and jet has collapsed by about as much 35 million barrels a day.

“Russia was the one that refused the agreement” in early March, the Saudi foreign ministry said. “The kingdom and 22 other countries were trying to to persuade Russia to make further cuts and extend the agreement.”

Sponsored by Trump, who’s fretting about the future of America’s shale industry, momentum for a new agreement had built in recent days.

A delay is “not a good sign,” said Ayham Kamel, head of Middle East and North Africa at the Eurasia Group consultancy. “This entirely plays negatively for the discussions.”

“Part of Putin’s comments are about saving face and also justifying why the oil price crashed and partly to deter criticism from the U.S. Putin doesn’t want to be blamed for any losses in the U.S. energy industry. It seems to me that there’s both a defensive effort to shield from criticism abroad for both the Saudis and the Russians,” Kamel said.

Blame Game

Putin acknowledged the need for a deal on Friday, saying Russia was willing to contribute cuts. This could be 1 million barrels-a-day if the U.S. joins, according to four people familiar with sentiment in the industry.

But he also put responsibility for the downward spiral in prices on Saudi Arabia.

“It was the pullout by our partners from Saudi Arabia from the OPEC+ deal, their increase in production and their announcement that they were even ready to give discounts on oil” that contributed to the crash, along with the coronavirus-driven drop in demand, he said.

“This was apparently linked to efforts by our partners from Saudi Arabia to eliminate competitors who produce so-called shale oil,” Putin continued. “To do that, the price needs to be below $40 a barrel. And they succeeded in that. But we don’t need that, we never set such a goal.”

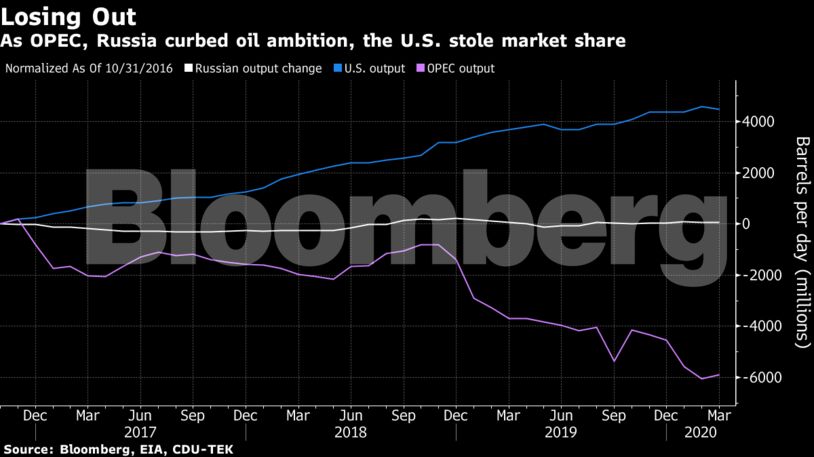

In fact, at the time the deal collapsed, Russian officials said privately they were seeking to do just that: use lower prices to force U.S. shale producers from the market and reverse some of the losses in market share they’d seen in recent years.

Since the original OPEC+ deal fell apart at a March 5 meeting in Vienna, the Saudis have argued Russia decided to walk away and was first to say countries were free to pump as much as possible.

Prince Abdulaziz, the energy minister and half-brother of Crown Prince Mohamed bin Salman, made the same point in his statement on Saturday.

“The Russian Minister of Energy was first to declare to the media that all the participating countries are absolved of their commitments,” he said. “This led to the decision by countries to raise their production in order to offset lower prices and compensate for their loss of returns.”

But the end of OPEC+, first forged in 2016, reflected long standing tensions between the two most important members in the 24 nation alliance. Saudi Arabia was shouldering most of the burden, producing more than 2 million barrels a day below capacity, while Russia had made a more nominal contribution.

The Saudis, who have ramped up production to a record 12 million barrels a day in the past month and massively discounted the price of their oil, have insisted a new agreement must involve significant contributions from all OPEC+ nations and major producers outside the coalition, including the U.S. and Canada.

“No one had expected such a total collapse in the oil market,” said Fyodor Lukyanov, head of the Council on Foreign and Defense Policy, a research group which advises the Kremlin. “Saudi Arabia and Russia have lost control of the situation. Tearing up the OPEC+ deal caused a lot of hurt feelings in Moscow and Riyadh, for Putin and MBS. That makes things more difficult, they have to get over that while not losing face. That’s why they’re both pointing the finger at each other.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS