By Andy Hoffman

Yet while the knock-out performances have provided some breathing room, problems which have long loomed over the trading houses haven’t gone away.

Gunvor and its billionaire owner, Torbjorn Tornqvist, are still searching for an investor or strategic partner to provide the 66-year-old Swedish national with an avenue for cashing out some of his 80% stake.

Trafigura, meanwhile, continues to strain under a weighty debt-load after a decade-long asset spending spree, on top of problems with its Puma Energy subsidiary. Its accounting has also come under fire from short-seller Iceberg Research.

Gunvor, which like Trafigura has its main trading operations in Geneva, was facing an existential crisis less than 24 months ago. The Company suffered a massive $330 million loss in 2018 as dismal results, legal provisions related to a case in China and a Swiss investigation involving bribery in Africa battered its bottom line.

Worried Bankers

That worried some of the bankers who provided Gunvor with short-term loans — the lifeblood of any commodity trader — said Jean-Francois Lambert, an industry consultant and former trade finance banker at HSBC.

“Gunvor was in danger two years ago,” Lambert said, but last year and the start of 2020 was a significant improvement. “This puts them in a much better position to build partnerships and diversify their capital base,” he added.

The situation in 2018 forced Tornqvist to restructure Gunvor, shedding veteran traders and putting new executives in charge of some departments including crude oil and liquefied natural gas. He also put assets, including its stake in a Russian oil products terminal, up for sale.

In need of cash, Tornqvist approached potential buyers interested in a minority stake in Gunvor including Vitol Group Ltd., Mercuria Energy Group Ltd. and Algeria’s state-oil company Sonatrach, though a deal was never completed.

Record Profits

Everything changed in 2019. Not only did the firm cement its position as the biggest independent liquefied natural gas trader, it pulled off its best gross profit performance ever from trading. While full-year results haven’t been released, Tornqvist said in October that Gunvor’s gross profit from the first nine months of 2019 topped $800 million and net income had already eclipsed the $330 million it lost the year before.

Buoyed by the results, Gunvor has now shelved plans to sell a stake in its German refinery and is taking its time in the search for investors and the sale of its stake in an oil terminal in Ust-Luga, Russia.

“There is certainly today no financial need for a partner,” Tornqvist said in a statement. “When it comes to partnerships, we are open to them in assets if we think that it will work better from a commercial point of view.”

Gunvor isn’t the first big oil trading house to search for an outside investor. Rival Mercuria held a process in 2015 that resulted in state-controlled China National Chemical Corporation Ltd, known as ChemChina, buying a 12% stake in the Swiss company. However, a follow up investment by ChemChina announced in 2018 hasn’t been completed.

Gunvor now has far less pressure to seek partnerships or diversify its capital in haste, said Lambert.

Trafigura, meanwhile, reported in December that gross profit from oil trading surged to a record $1.7 billion in 2019. Like Gunvor, it had also restructured its energy trading operations while taking advantage of price swings and supply outages. However, asset write downs and adjustments to the value of securities related to its iron ore port in Brazil as well as zinc smelter Nyrstar contributed to its lowest profit in nine years as net income fell 0.5% to $868 million.

Puma Problem

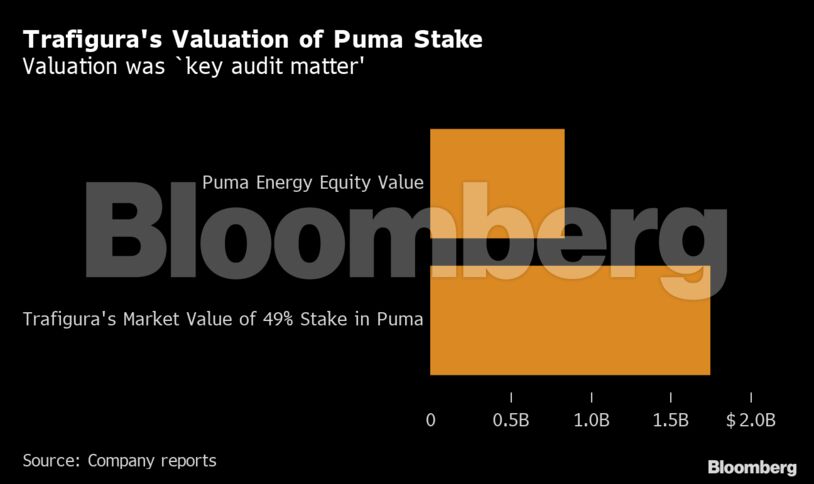

Emerging market fuel retail and storage unit Puma, in which Trafigura owns a 49% stake, may pose its biggest challenge.

Puma’s business has been hammered by a fuel price freeze and currency plunge in Angola one of its biggest markets. It’s also been strained after a multibillion-dollar spending spree from Myanmar to Latin America.

“Puma is facing structural issues in Angola that used to be the cash cow,” said Arnaud Vagner, the head of short-seller Iceberg Research, who said he had a short position in Trafigura debt securities. “It is deeply overvalued on Trafigura’s balance sheet.”

Vagner rose to prominence as a critic of Noble Group Ltd., once Asia’s largest commodities trading house. Noble eventually crumpled amid accounting critiques from Iceberg and wrong bets on commodities.

Iceberg and its founder Vagner turned attention to Trafigura last year, criticizing its valuation of securities related to its stake in an iron ore export terminal in Brazil. Trafigura said in its annual report it had cut the value assigned to the Brazilian port securities by $121 million. Vagner contends that Trafigura’s bottom line was largely unaffected by the near half-a-billion dollar loss by Puma. He also questions the valuation of Puma on Trafigura’s books.

“If Trafigura’s stake in Puma Energy was overstated or overvalued, it would not have passed the impairment test,” a Trafigura spokeswoman said in a statement, referencing work by its auditor PriceWaterhouseCoopers.

Trafigura’s problems with Puma and other infrastructure investments compares unfavorably to similar moves by Vitol, the world’s biggest independent oil trader. Vitol’s investment in Shell-branded service stations in Africa Vivo Energy Plc. pulled off London’s biggest new stock-listing in 2018. Handling more than 7 million barrels of crude and products a day compared to about 6 million at Trafigura, Vitol also has a more conservative balance sheet that Trafigura when it comes to debt.

Tackling Debt

In response to the crisis, Puma hired a new chief executive last year and has sold assets. A company turnaround is “on course,” Trafigura said in its annual report.

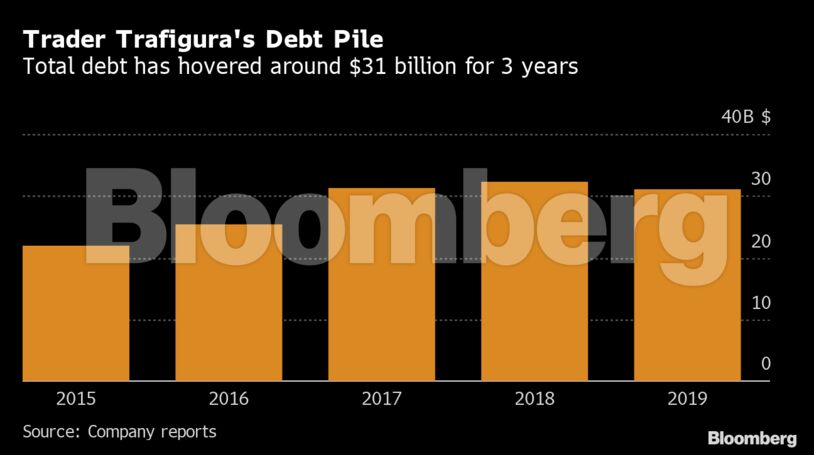

Buoyed by its strong trading results, Trafigura began tackling its total debt burden in 2019 which fell 4% to $31 billion. While that’s still higher than its peers, the company says it has consistently improved key financial ratios since 2016 including adjusted debt to equity which fell to 0.78 times last year, well below its target ratio of 1 times.

Trafigura’s own equity value rose by about 9% to $6.8 billion last year. That was due, in part, to a significant drop in employee share buybacks, the principal way the firm returns capital to its shareholders, which fell to the lowest in at least eight years.

Lambert said that as long as both Trafigura and Gunvor’s strong trading results continue booming lenders will remain at ease.

“Banks are mindful of the business pattern of a large commodity trader and are comfortable with the track record,” he said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS