By Grant Smith and Alex Longley

Under increasing pressure after crude prices sunk below $50 a barrel for the first time in more than a year on Monday, technical experts from the Organization of Petroleum Exporting Countries and its allies will meet at the group’s Vienna headquarters to evaluate the disease’s impact, where they will also be joined by China’s ambassador to the United Nations. The outcome of the discussions may determine whether the group convenes an emergency meeting to consider new output cuts later this month.

So far, the virus has upended trade flows and probably led to a 20% cut to China’s oil demand — the world’s biggest importer– as cities are quarantined and factories are halted. Refineries are curbing operations and shutting plants, while the nation’s top processor is seeking to re-sell millions of barrels of West African crude it no longer needs because of the squeeze to consumption. The crisis could wipe out a third of the growth in global consumption this year, said BP Plc Chief Financial Officer Brian Gilvary.

“The problem for OPEC+ is that the size of the demand destruction in China is not known,” said Petromatrix analyst Olivier Jakob. “It is therefore difficult for market participants to be convinced that an additional cut of 1 million barrels a day will be enough. In the current environment, a cut of 0.5 million barrels a day is going to be quickly discounted.”

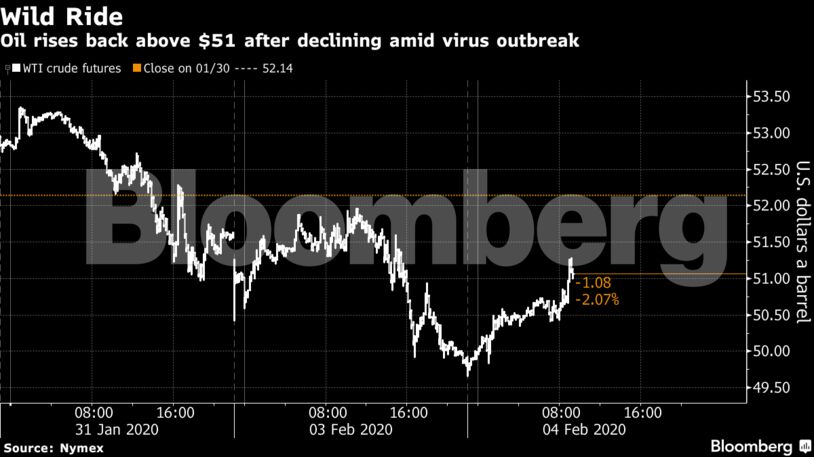

West Texas Intermediate for March delivery added 70 cents to $50.81 a barrel on the New York Mercantile Exchange as of 11:39 a.m. in London. The contract slumped 2.8% on Monday to the lowest since January 2019. International benchmark Brent gained 0.7% on Tuesday, trading at $54.82 a barrel.

Though oil’s near-term contracts were recovering, there was no similar move in the oil market’s structure. The nearest Brent spread was languishing in a bearish contango structure — indicating oversupply — trading about 6 cents weaker than Monday’s close.

The prices of commodities from energy to metals have stabilized, while iron ore and crude in China recovered some ground. The tentative recovery came even as steel mills and processing plants remain shut throughout the country. Officials are reviewing whether to soften the economic growth target for 2020 and authorities in Beijing are hoping the U.S. will agree to some flexibility on pledges in their phase-one trade deal due to the virus outbreak.

See also: Driven by China, Oil Prices Near U.S. Shale Hedge Danger Area

An OPEC+ ministerial meeting is scheduled for March, but the group is considering whether to hold that gathering earlier to respond to the virus. Russian President Vladimir Putin and Saudi King Salman bin Abdulaziz discussed the market by phone on Monday and confirmed “readiness to continue cooperation.” Russia is ready to participate in any OPEC+ meeting that is called, a Kremlin spokesman said on Tuesday.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS