By Rachel Adams-Heard and Catherine Ngai

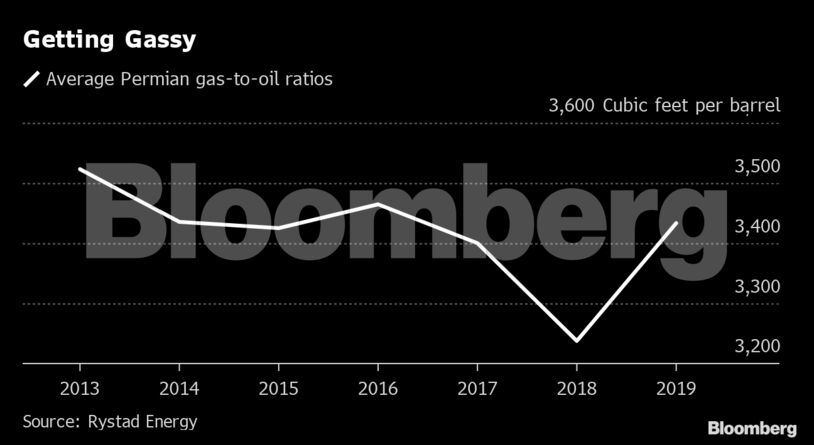

Shale wells produce a spew of oil when they’re first fracked, but over time, production falls — sometimes as much as 70% in the first year — and gas becomes a bigger part of the mix.

“Activity levels are no longer what they were,” said Artem Abramov, head of shale research at Rystad Energy. “The oil ratio is no longer sufficient to offset gas in older wells, so we’re seeing some increase in basin-wide” gas-to-oil ratios.

In the Midland portion of the Permian, the average well produces about 2,000 cubic feet of gas for each barrel of oil in its first year, according to Tom Loughrey, a former hedge fund manager who started shale data company Friezo Loughrey Oil Well Partners LLC, or FLOW. Over the lifetime of those wells, about 30 years or so, that rises to an average of about 5,000. It can climb as high as 7,000 in the gassier Delaware.

What BloombergNEF Says:

“Shale wells are notorious for their steep output declines; however, that decline is more severe for oil than for gas and NGLs [natural gas liquids]. Gas and NGL production continues for much longer, increasing the gas-to-oil ratio (GOR) of most U.S. shale plays.”

— Analysts Anastacia Dialynas, Juan F. Bautista and Tai Liu

–Click here for the research

It’s an issue that’s made worse when subsequent wells are drilled too close to the initial one, or when there’s interference from another producer’s neighboring wells.

Diamondback Energy Inc. emerged in November as a victim of this phenomenon when it reported third-quarter well results that were disappointingly gassy. The percentage of oil was 65%, the lowest since at least 2011, which it blamed on a nearby producer who took too long to frack its wells. The company also revised its expected crude ratio for 2019 to 66%-67% of production versus 68%-70% previously.

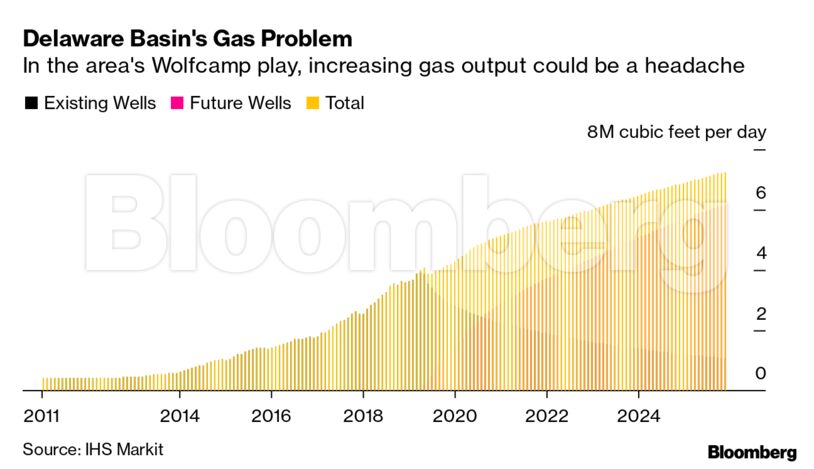

Then there’s the fact that in recent years investments have shifted to the Delaware, where output is much gassier than in the historic Midland portion of the Permian.

“Almost all, if not all, of the gas supply growth next year is coming from the Delaware Basin, whereas most other basins are staying flat or even decreasing,” said Ryan Luther, a senior research associate for RS Energy Group Inc. “It’s something that can be particularly challenging for the Permian operators because there is that pipeline constraint.”

In April, gas traded at the Waha hub in West Texas dropped to minus $4.63 per million British Thermal units. In other words, producers had to pay to get their gas taken away.

Smaller producers with rising gas ratios have taken the hardest hit as prices tanked. Over the last year, Approach Resources Inc. has reported oil production that was less than one quarter of its total output. The company filed for bankruptcy protection in November.

Producers in the Permian are already flaring record levels of natural gas. The Texas Railroad Commission, which oversees the oil and gas industry in the state, has granted nearly 6,000 permits allowing explorers to flare or vent natural gas this year. That’s more than 40 times as many permits granted at the start of the supply boom a decade ago.

While flaring gets rid of the methane, it still releases carbon dioxide and other particulates into the air. The agency’s tendency to approve all flaring permits is now the subject of a lawsuit brought by pipeline operator Williams Cos. The company recently lost a case in front of the commission, arguing that producer Exco Resources Inc. should use Williams’ pipeline system instead of burning off unwanted gas.

U.S. Energy Secretary Dan Brouillette put the Permian’s gas problem down to infrastructure.

“Even if we could capture the gas, it’s not clear we could get it to the marketplace,” he said in an interview in Washington last week. “We just need more pipeline capacity.”

There aren’t any major gas pipelines set to come online next year. Kinder Morgan Inc. recently delayed its Permian Highway gas pipeline to 2021, citing red tape.

But not everyone agrees that the Permian’s flaring problem can be chalked up entirely to a lack of pipelines.

“Pipeline capacity is going to end up helping, but it’s not going to solve the issue,” said Colin Leyden, senior manager of regulatory and legislative affairs at the Environmental Defense Fund in Texas. “There’s no doubt that folks are absolutely fed up with the amount of waste and pollution coming from the Permian Basin.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS