By Jacquelyn Melinek

“Obviously we are a little concerned about the trade war,” said Phil Flynn, senior market analyst at Price Futures Group in Chicago.

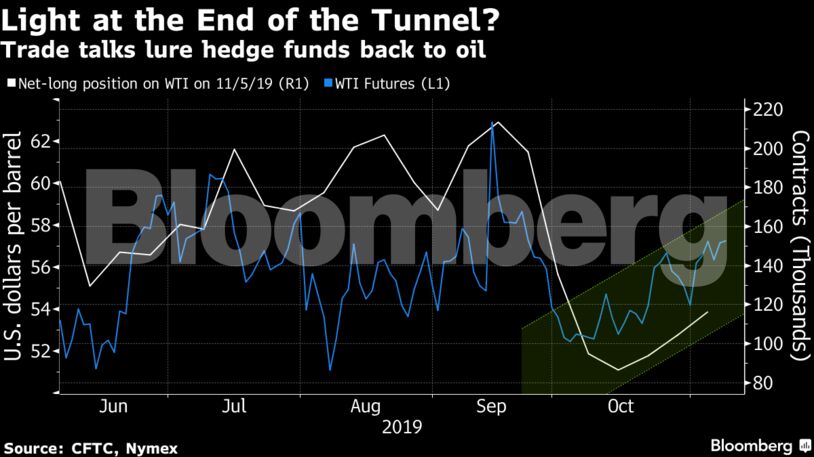

Oil has rallied more than 8% since early October amid signals the U.S. and China were moving closer to settling the protracted trade dispute that’s undermining energy demand. Hedge funds have cautiously revived bets on rising prices.

West Texas Intermediate for December delivery fell 0.6% to $56.91 a barrel at 12:34 p.m. on the New York Mercantile Exchange.

Brent for January delivery fell 20 cents to $62.31 on the London-based ICE Futures Europe Exchange. The global crude benchmark traded at a $5.32 premium to WTI for the same month.

See also: Aramco IPO Prospectus Flags Peak Oil Demand Risk in 20 Years

“These days it’s largely the trade war” that’s moving prices, Bob McNally, president of Rapidan Energy Group and a former oil official at the White House under President George W. Bush, said in a Bloomberg TV interview on Monday. “Folks are also looking into early next year and seeing an oversupplied market, and there’s questions whether OPEC+ will rise to the challenge.”

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS