Futures lost as much as 1.9% in New York. The U.S. and China have agreed to roll back tariffs on each other’s goods in phases as they work toward a deal, giving some relief to the outlook for oil demand. Yet American crude inventories jumped last week, and delegates from the Organization of Petroleum Exporting Countries and its allies say the group’s biggest producers aren’t pushing for further intervention to clear up a global excess.

“The U.S.-China trade talks are heading in the right direction” but “there are still several obstacles that will need to be overcome,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. in London. “The road to a final resolution will be bumpy. The upside for the risk-asset complex is limited and the current momentum is built on wobbly foundations.”

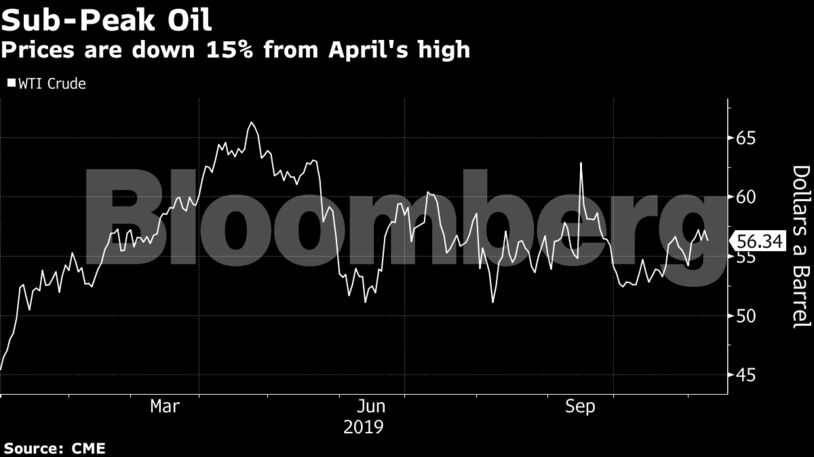

Oil has fallen about 15% since hitting this year’s peak in April as the trade spat saps crude consumption and global supplies expand. OPEC and its partners will probably keep output steady when they meet next month as markets are on track to rebalance, according to Goldman Sachs Group Inc. and Trafigura Group Ltd.

WTI for December delivery declined $1.02 to $56.13 a barrel on the New York Mercantile Exchange as of 9:10 a.m. local time. The contract rose 80 cents to $57.15 on Thursday.

Brent for January settlement fell $1.21, or 1.9%, to $61.08 a barrel on the London-based ICE Futures Europe Exchange. The contract is down 0.9% this week. The global benchmark crude traded at a premium of $4.97 to WTI.

See also: PetroChina’s Market Cap Slide Continues as It’s Passed by Total

Rolling back tariffs would pave the way for a de-escalation in the trade war that’s cast a shadow over the world economy. China’s key demand since the start of negotiations has been the removal of punitive tariffs, which by now apply to the majority of its exports to the U.S.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS