By Sheela Tobben

Some sellers have held back from offering cargoes, while others have yet to reduce their offers enough to accommodate the rising cost of shipping oil, according to 10 market participants. Buyers are holding out for deeper discounts after sanctions on units of China’s COSCO Shipping Corp. took away tankers from the global shipping pool, they said. As a result, hardly any deals have been booked over the past few days, compared to six or seven seen in a typical day.

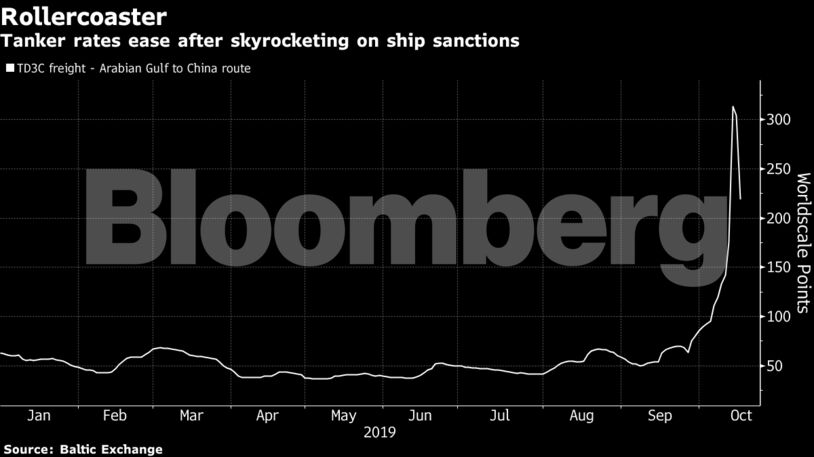

Benchmark rates surged to about $300,000 a day last week for shipments from the Persian Gulf to the Far East, while one supertanker was booked to carry oil from the U.S. Gulf to Asia for more than $15 million. Indian Oil Corp. said the rising costs are forcing it to cut spot purchases. Shipments to Europe on smaller tankers have increased in the first half of the month as rates for larger vessels skyrocketed, according to Vortexa Ltd.

The increased shipments to Europe may tail off as the impact of attacks last month on Saudi oil infrastructure fades, said Stefanos Kazantzis, McQuilling Services LLC‘s senior adviser for shipping and finance. “We are not seeing yet the same volumes fixed for second half October as we did for first half for U.S. crude shipments to Europe.”

U.S. sellers have the option of supplying domestic refiners who can still absorb the local shale, so there isn’t pressure to sell their cargoes overseas, said according to Andy Lipow, president of Lipow Oil Associates LLC in Houston. Companies also have the opportunity to store the barrels in abundant onshore tanks, he said, noting that storage can be obtained as cheap as 50 cents to 60 cents a barrel per month.

READ: U.S. Oil Exporters Ramping Up Flows to Europe as Freight Surges

Gulf Coast crude stockpiles were 221.4 million barrels as of Oct. 9, about 61% of the 365.4 million total working capacity at refineries and tank farms, according to the U.S. Energy Information Administration.

While few trades are getting done, price assessments are starting to slip. West Texas Intermediate crude for loading onto a ship was $2.83 a barrel below Brent futures on the Intercontinental Europe Exchange Monday, from a $1.48 discount on Oct. 7, according to Argus Media.

Port Slowdown

Some businesses associated with exports, such as volume-measuring and quality-testing, have also seen a decline because fewer trades are getting done. For one U.S.-based company, activity is down some 10% from the same period last year, said a person familiar with the matter.

Corpus Christi, Texas, where oil exports grew to more than 685,000 barrels a day in August from 553,000 in January, is expecting slower growth because of the freight costs.

“The Port of Corpus Christi is preparing for a slower U.S. crude export growth rate from its site in November because of the surge in freight rates from the Cosco sanctions,“ said Sean Strawbridge, the chief executive officer of the Port of Corpus Christi.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS